Greedspin

The Age of Turbulence, Alan Greenspan, 2007

Memoirs of a Naive City Kid

Confessions of a Naked Bad Numbers Ideologue Zealot

Pray with us to the Invisible Hand that Steadies the Economy

Was there something about George Washington High School where Alan Greenspan and Henry Kissinger were classmates that produces ethically challenged citizens with zero empathy?

Enrolled in a PhD program at Columbia in 1950, Greenspan apparently managed to navigate the campus without meeting a single liberal professor. His doctoral adviser Arthur Burns admonished his students “Excess government spending causes inflation.” Greenspan learned econometrics which he treats like a religion from Jacob Wolfowitz, father of Paul, architect of the new Iraq and discredited former president of the World Bank. Not satisfied with his conservative professors in the liberal hotbed that was Columbia see, Greenspan develops a thirty year admiration for Ayn Rand and still calls himself a libertarian Republican. Greenspan was sorry that Soviet hating Rand did not live to see the economic collapse of the Soviet Union. Greeenspans spends many pages gloating over the demise of central planning on her behalf. He particularly enjoyed Putin’s economic adviser wanting to talk to Greenspan about Rand.

On the origins of Greenspan’s notorious Fedspeak, he offers this book inscription written by his father:

May this my initial effort with constant thought of you branch out into an endless chain of similar efforts so that at your maturity you may look back and endeavor to interpret the reasoning behind these logical forecasts and begin a like work of your own.

The skill is obviously inherited. On his honeymoon:

Venice, I realize is the antithesis of creative destruction. It exists to conserve and appreciate a past, not create a future… The city caters to a deep human need for stability and permanence as well as beauty and romance… Silicon Valley is without question an exciting place to work, but its allure as a honeymoon destination has, I would guess, thus far gone largely unrecognized.

Chinese learn creative destruction during .com bust

He spends a lot of time talking about creative destruction as a driving force for economic expansion. It is a little like Blood and Guts Patton’s grunt’s comment; “Yeah, his guts, my blood.” The costs of creative destruction are largely borne by the worker, the little guy who gets crushed in the process. Yet Greenspan is highly skeptical of social safety nets to protect the falling workers. He talks about cultural differences where Germany, France, Italy, and Japan are more sensitive to the plight of the workers. He seems proud that Americans can be so indifferent to suffering in the greater interest of economic expansion.

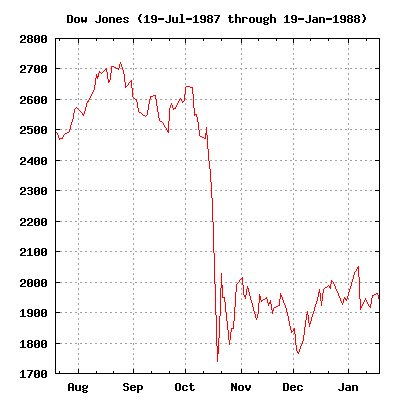

Greenspan becomes FED Chairman 3 days before Black Monday. Guess he didn’t have time to perfect his Fedspeak yet.

He formed a close working relationship with Clinton’s Bob Rubin and Larry Summers and the Clinton era resulted in record budget surpluses projected to increase indefinitely into the future. By 2006, the national debt would be totally paid off. Greenspan and Bush’s about to be fired treasury secretary Paul O’Neill worried about what to do with the huge surplus. It is strange that someone who can’t figure out what to do with the government surplus strongly recommends private social security accounts where every busy American gets to figure out how to invest his surplus (retirement funds), especially since the retiree won’t be able to borrow his way out of a fiscal mess and will starve if they guess wrong.

Evidence of his incredible political (and social) naivety is given in this summation from the New York Times in 2001 concerning his testimony to Congress:

Just as his hedged backing of Mr. Clinton’s plan provided invaluable political cover… as [the Democrats] voted to increase taxes, his guarded endorsement of a tax cut today gave new impetus to the efforts by Republicans to push thought the biggest tax cut since the Reagan administration.

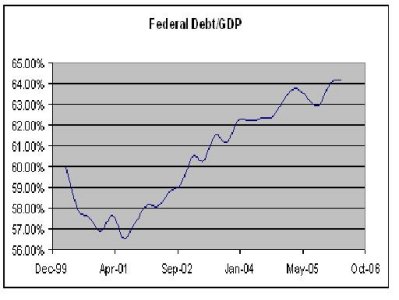

A monumental failure of econometric measurement and projection was about to occur. Tax Receipts for 2002 shrunk from estimates by $376 billion. Of this only $75 billion could be attributed to Bush tax cuts. Most of the rest was due to blown estimates of revenue from capital gains as stocks went south taking stock options with them. A projected debt to the public of $1.2 trillion under Bush policies, by 2006, turned into a debt of $4.8 trillion. Oops! That’s a 400% projection error! No apologies.

Most of what supported consumer spending through this period was housing. Greenspan lauds the increase in home ownership to 69% in 2006 due to low mortgage interest rates while seemingly overlooking the sub prime variable rate mortgages that from the very beginning were ticking time bombs. So much for an econometrician’s forecasting ability.

Shenzhen Built by FDI

Greenspan spends several chapters gloating over the failures of socialism in Europe and India and the collapse of central planning in the Soviet Union and Eastern Europe. He spends several chapters on China, the Asian Tigers, and India, where economic progress is almost all due to direct foreign direct investment (FDI) which requires special zones and protection of property rights (profits) whereby foreign capital can take advantage of local low wages. Vietnam is the current record holder of highest ratio of FDI to GPD at 61%. India is 6%, Pakistan is 9% China is 14%. The Asian economic miracle is all about foreign capital seeking cheap labor.

His Latin American chapter is largely a lament that populism which led to such reforms as nationalized oil in Mexico in the 30’s and in Venezuela today has had such dire consequences throughout the region. Despite huge disparities in wealth between the few and the many, capitalism should be allowed to play out for the good growth of the economy. He forgot to mention that a rising tide raises all boats (and drowns the vast majority of the population without life rafts). Fedspeak apparently doesn’t allow mantra spouting.

He also talks a lot about a phenomenon known as the Dutch disease whereby any country with a valuable natural resource such as gold, diamonds, or oil has its economy skewed as a result as is economically harmed by the resulting distortions. The affected country’s foreign exchange value of its currency is driven up making other exports less competitive. Even Britain was affected by North Sea oil in this way.

Here are highlights from his more misguided pronouncements and predictions (I’m 81. I was paid $8 million to write this. What do I care.)

On Health Care and Medicare He has clearly not read The Health Care Mess. Based on state studies, it is estimated that 25% of health care costs go directly to HMOs that produce no health care. So 4% of GDP may go directly to an administrative function of no benefit to the health of the nation and even worse that inhibits access to health care. If this is correct, then HMOs consume the same portion of our wealth as our entire military industrial complex, that is, defense. Greenspan, the numbers man with 18 years unique access to detailed actual numbers, should know this but doesn’t talk about it. Instead:

* The cost of health care is being driven up by technology (No supporting evidence.)

*The Boomers will bury the Medicare program. It will need extensive gutting with 100% copays (HMOs pocket the government subsidy and the patient pays everything!)

On Increased Income and Wealth Disparity

* Hope that growing dissatisfaction doesn’t lead to populism and policies that might ruin the economy.

* Import more educated work force from abroad who will be grateful for their pittance pay.

On Energy from Oil He obviously has not read Twilight of Oil

* Oil production will peak in 2050. (Sorry, it has already peaked)

* Speculators control of oil supplies has grown sixfold in the last 2 years. Speculators stabilize supply and prices. (You’re kidding?)

* A stable Iraq will produce large quantities of oil. (Yeah, right!)

* OPEC has 3/4 of the world’s oil reserves led by Saudi Arabia’s 260 billion barrel reserve. (Reserves are mythical.)

* Exploration will find more oil. (The last major finds were made in 1969. Clinton bit on this one.)

* Domestic oil producers should invest in refineries (Why, when oil is running out?)

* We will never ween ourselves of oil. (We will when we run out.)

On Alternate Energy He has obviously not read Oil and Alternatives

* Build more nuclear power plants (Ignore the shortage of nuclear fuel.)

* Wind and solar is good only for small scale deployment. (No evidence.)

* The market is buying fuel efficient cars (Have you visited an SUV infested shopping mall parking lot lately?)

* Hybrids are too quiet. (He recommends adding big engine sound effects.)

Windmill Dike

On Global Warming

* Build dikes. The Dutch have done it for years. (He’s not kidding!)

* Rename Glacier Park

* We will never reduce greenhouse gas emissions. (Live or die by those fossil fuels.)

* Hurricane Katrina disrupted our oil supply.

Enron Award 2001

Greenspan was awarded the Enron Prize in 2001 as the company collapsed. Having served on many board of directors for fortune 500 companies, he is not at all critical of interlocking directors, CEO appointed board members, the insider racket that is modern corporate top management, only of management that can’t make a profit.

On Corporate Governance

* If Corporations make huge profits why shouldn’t CEO’s get huge rewards.

* Sarbanes-Oxley that makes the CEO liable for accounting fraud goes too far.

* Whistle blowers are the best way to expose bad governance. (And ruin the whistle blower)

* The best way to remove bad management is the corporate takeover, probably hostile.

Greenspan is a throwback with his Adam Smith invisible hand and Ayn Rand brand of liberalism. The invisible hand is his crutch for explaining all the things he doesn’t understand and all the monetary policy moves that failed during Paul Volcker’s and Greenspan’s terms as FED chairmen. Volcker tried everything to control inflation and at the end we still had speculators in Miami buying condominiums with 18% mortgages and 12% savings accounts. When inflation and interest finally dropped, the Savings and Loan industry collapsed and Black Monday happened.

When Long-Term Capital Management was collapsing in 1998 Greenspan and the Fed along with Rubin and Summers called on Wall Street giants to rescue the ailing hedge fund monster. When do you sit back and watch the invisible hand at work like the Savings and Loan collapse and when do you step in to intervene in the madness? For evidence that the global economy may be shakier than we think see the Shaky Globe.

Greenspan doesn’t discuss Republican runaway spending and record deficits as playing a role in leveling the market plunge after the dot com bust. Eventually, without any apparent help from monetary or government policy, the invisible hand of the benevolent father reached down to rescue and stabilize the economy. If you can’t believe your numbers and models and your political party abandons your principles, you have to believe something. You can be an idealogue where mere facts don’t matter, or you can be an econometric numbers man. You can’t be both and judging from this book, Greenspan chose to be an idealogue.

Adam smith himself only mentions the invisible hand three times but true believer Greenspan calls on it at least seven times in his book, almost like a prayer.

The modern libertarian looks, not to Adam Smith and Ayn Rand for inspiration but to John Nash and his disciples. The game theorists devised artificial adversarial games that could be analyzed mathematically. They found that the outcomes of their games were maximized when every player acted according to their individual self interest. Game theory was quickly adopted by libertarians and applied to economics. Charles Wilson old “What’s good for General Motors is good for the country.” was transformed by game theory libertarians into “What’s good for a country’s greedy corporate managers is good for the country.” Individual greed benefits everyone. For a frightening look at the effects of metricizing everything and applying the adversarial game theory approach pioneered by John Nash and first applied to economics see The Trap.

Greenspan is someone who made numbers almost a religion. How could he get so many numbers so wrong for so long? And why are so many pronouncements without statistical support? And why aren’t the reviews calling him on his errors and omissions? How could he be so audacious, with his track record, as to predict the future which he does in the final chapter The Delphic Future? This oracle is blind.