Blood in the Water

Too Big to Fail, Andrew Ross Sorkin, 2009

This book focuses on the period from the sale of Bear Sterns to JP Morgan (JPM) in March 2008 through the climactic weekend in September 2008 that decided the fates of Lehman Brothers, Merrill Lynch, and AIG, and finishing with the nine biggest wall street firms being forced to accept TARP money in exchange for stock warrants; the unthinkable temporary nationalization of the American financial system in October 2008 by a Republican administration. Like the account of Bear Sterns collapse, this book reads like a page turning novel.

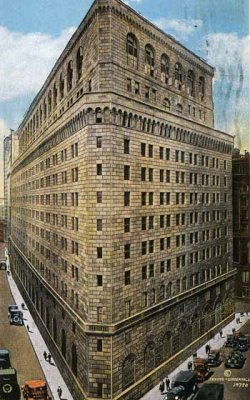

Lehman Headquarters

Unlike William Cohen’s account, this book does not give a detailed history of the central firms, or attempt a detailed explanation of the securitized mortgages, sub-prime mortgages, and credit default swaps (insurance policies) at the heart of the crisis. Instead, Sorkin argues that even Alan Greenspan, with his extensive mathematical training, was unable to grasp the new investment vehicles, so clearly the wall street executive decision makers, the risk assessors, and the ratings agencies were unable to understand the investments they were rating or making. In other words don’t even try to understand the things at the very heart of the crisis. The only clear thing is that the real estate bubble burst and everyone’s home has lost value, along with 401Ks, etc.

Thus the Quants (quantitative analysts) who invented the complex strategies and instruments that led to the collapse of LTCM in 1998, who invented hedging investment strategies universally accepted whereby big investors hedge their risky investment bets by also betting on the opposite outcome, and who invented securitized asset vehicles that carve up a bundle of individual loans or assets into different risk valued slices that can be sold separately making it almost impossible to find or value the original loan or asset, and finally to credit default swaps (CDOs) as insurance or hedge options which serve to give the appearance of low risk and allow the investor to leverage their investments even further, go largely unexamined here. Someone needs to write a book about these creative geniuses whose work nearly brought on the second great depression.

Ultimate Gambler Einhorn

Some attention is given to short sellers like noisy David Einhorn who featured large in the demise of Bear Sterns. Once Bear was gone, Einhorn immediately focused on Lehman, calling into question their accounting and asset valuations. Thus was launched the short selling that quickly drove Lehman stock into the ground. The other Wall Street firms well understood the dynamic that they would be picked off one by one by the short sellers in order of size Bear first, following by Lehman, Merrill, Morgan, and Goldman. Citicorp was not far behind. But until it was their turn as the biggest firm still standing they said little about the practice. The short sellers were not limited to those who invest solely on the basis of shorting stock, but has spread to hedge fund managers and other institutional investors who now believe it is necessary to hedge your bets by placing opposing bets in order to minimize losses. The CEOs at Bear, Lehman (Fuld) and Merrill (Thain) railed against the short sellers but the government never seriously considered stopping the practice. They played with the uptick rule which Sorkin says is easy to get around. The British, by contrast, banned short selling for 30 days at the height of the crisis.

The Losing CEOs in Denial Thain Fuld Cayne

From March to September, the heads of all remaining investment banks on wall street should have seen the writing on the wall with the collapse of Bear Sterns and sought shelter through acquisition or transformation (to a bank or bank holding company) but the CEO of each, particularly Dick Fuld of Lehman and John Thain of Merrill remained in denial of the new realities of their world. Despite repeated pressure from Paulson at Treasury to raise equity or find a buyer both dithered the months away until it was too late. The section dealing with this interval reads like the lives of the rich and infamous as we meet and follow the handful of “masters of the universe” as they go about their daily lives; the private jets, the second homes, the globe trotting, the exclusive conferences. We meet second tier executives who need $13 million a year just to support their life style. No bridge players here but several masters ski regularly at Vail. The hobby of choice is golf with one CEO getting in 13 rounds of golf a week as his company goes up in flames. (Does even Tiger ever play 13 rounds of golf in a week?)

What really strikes home is how few masters of the universe there are and getting fewer by the day. They all know one another and share career histories as they move from firm to firm or into and out of government. Typically CEOs have previously lost battles for the top spot and retain that bitterness. They share a lack of trust in one another and seldom miss the chance to exploit an opportunity at the expense of a rival. In any crisis like those of last year they gather like sharks to try to learn the inside secrets of the failing firms and see what parts they may be able to devour or steal. They are less than honest even with themselves and seldom even consider the stockholder’s interests except to the extent that they themselves hold stock. They measure themselves in terms of their total compensation and not the success of the companies they lead. More and more, their compensation is untied to stocks and they can maximize their bonuses by creative accounting right up to day they file for bankruptcy. There are so few of them and now even fewer after the events of the last year that they can sit around a small conference table. A surprising number of them were mentored by Robert Rubin as if they are all his children, even Geithner. Warren Buffet hates and distrusts them all but still willing to capitalize on an opportunity if it is sweet enough.

The Key Government Players Paulson, Bernanke, Geithner, Duggan, Cox

The unexpected exception here is Paulson, a Christian Scientist, who lives comparatively modestly with a 1200 square foot apartment in New York, who hates traveling by private jet, who likes to ride his bicycle with his wife Wendy around Rock Creek Park in Washington, and whose main indulgence seems to have been the purchase of a piece of a bird preserve island in Georgia for $30+ million. Not expectantly, Paulson is the central character in this drama.

As to the conspirator’s government Goldman, Sorkin doesn’t believe it but recognizes how many Goldman CEOs have served in government. He relates a delightful story of Secretary Paulson and the Goldman management team coincidentally in Russia at the same time arranging a secret meeting in Moscow and terrified word might leak.

New York Federal Reserve

Tim Geithner is the second central character as head of the New York Fed and who comes across as decisive but imperious, loving to order the masters of universe around like he is a school master giving exams to his pupils. The masters refer to him as the boy scout. Largely missing here is Ben Bernanke who comes across as professorial and detached, who frustrates both Geithner and Paulson for his unwillingness to use Fed powers in creative and expansive ways to deal with the unfolding crisis. Most of the climactic scenes in this book take place in the New York Fed building with one memorable scene where the emergency room with its defibrillator still hanging on the wall at the Fed is quickly converted into a conference room for the Lehman team during the fateful weekend. The irony is not missed by Lehman.

But lots is happening during the lull from March to September. Countrywide, Indymac, and Washington Mutual banks fail and are quietly taken over by the FDIC and Shiela Bair, the only woman of power in this story. Neither Geithner nor Paulson cares much for Bair but they respect her work and ultimately recruit her to help in the TARP bank takeover in October. Perhaps the most significant event of this lull is the failure and government takeover of Freddie Mac and Fannie Mae, a move engineered by Paulson, who many believe tricked congress into giving him authorization. Both Freddie and Fannie keep armies of lobbyists, are insular and arrogant, and can bring enormous pollitical pressure when given enough time. Paulson surprised everyone by instantly nationalizing both firms and firing their management in July. Had Freddie and Fannie who hold more than 50% of the countries mortgages and who freely participated in buying sub prime and mortgage backed securities failed, the entire financial system would have melted down.

And finally we get to the dramatic climax of the book, the weekend in September when a three ring circus is convened to determine the fates of Lehman, Merrill, and AIG. That’s right, all three outcomes were determined in one chaotic sleepless weekend. As we enter the weekend, it is understood that Lehman will not survive to open on Monday, it has been discovered that out of control AIG has another undiscovered $20 billion loss in a real estate investment division bringing its total immediate capital need to at least $60 billion.

Paulson has pressured Bank of America to purchase Lehman but insists that he has burned all his political capital with Bear and the takeover of Freddie and Fannie and will be unable to do a “Jimmie” (Dimond of JPM) where Treasury guaranteed $39 billion in losses for the purchase of Bear. British Barclay is also readying a bid for Lehman and neither BofA nor the British believe Paulson will not participate with a guarantee. Suddenly BofA decides that Merrill is a better fit and unknown to most participants, drops its efforts to acquire Lehman to concentrate of Merrill. Barclay finalizes a bid but at the last minute the British regulators and government refuse to allow the deal fearing the wall street contagion will spread to London (as if they were somehow insular otherwise). Out of time and out of options (how can Paulson and Treasury guarantee losses to a British company?) Lehman is forced into bankruptcy. Fuld alone loses $850 million in stock value. Barclay immediately approaches the bankruptcy judge to buy the New York trading arm (the piece they were after to begin with) and the judge agrees to sell to them to preserve the US jobs. In the meanwhile, and without government intervention or help, BofA agrees to buy Merrill. BoA comes to regret this decision as the true state of Merrill comes to light.

Geithner focuses on AIG this critical weekend and realizes that a failure and default on all its CDOs will be disastrous and collapse the financial system so he masterminds a takeover of AIG which takes place Tuesday and costs taxpayers almost $80 billion (now up to $180 billion). Paul Krugman joked that Paulson’s free market moral hazard lesson issued to Lehman had lasted all of 24 hours.

Joseph Cassano “Patient Zero”

Sorkin includes a picture of Joseph Cassano head of AIGs financial products unit intriguingly dubbed the man who crashed Wall Street. Like Ralph Cioffi of Bear, Cassano single handedly brought down AIG as his quants invented the CDO. Cassano used to brag that CDOs were so perfect AIG would never lose $1 on a CDO. The correct number is $180 billion and counting. Warren Buffet has called the CDOs weapons of mass destruction. More detail on Cassano’s activities and how it destroyed AIG would have been useful. Maybe another book? Incidentally, in a monumental miscarriage of justice, Bear Sterns’ Cioffi and sidekick Matthew Tannin were recently acquitted on charges of lying about their investments.

The book now winds down to the anticlimactic meeting in Washington where the nine largest financial institutions are forced to take government money and government participation. Did all this government intervention save us from catastrophe? Did Lehman’s bankruptcy make thing worse. Sorkin believes that the Fed and Treasury were winging it, moving from crisis to crisis and making numerous sequential and inconsistent decisions which confused the market. TARP was intended to correct this but somehow morphed from buying toxic assets to direct investment in banks. Sorkin thinks the government inconsistency rather than the Lehman bankruptcy itself exacerbated the problems in the markets. Had the government a better regulatory system in place to unwind failing wall street firms like the FDIC would the crisis have looked completely different and would the outcome have been better? One can only speculate.

So what did we learn from all this? Absolutely nothing according to Sorkin’s two page wrap up. Rather than fix some problems with regulation and orderly liquidation, Obama has moved on to other priorities. Wall street continues to focus on generating fees for themselves rather than clients. They see enormous potential profits from the collapse of the commercial real estate bubble. They are taking bigger risks than ever now that they know the government is there if they get into trouble. Even as bank holding companies, leverage is beyond belief. Egos are as big as ever. The survivors feel invulnerable. Humility is totally absent. Compensation and profits are at record levels. We eagerly await the next crisis. Too bad these two books aren’t really novels.