Scamming the President

Tuesday, December 20th, 2011Confidence Men, Wall Street, Washington, and the Education of a President, Ron Suskind 2011

The title is intended as a play on the word “confidence”, used to describe the primary motivations of Tim Geithner, Ben Bernanke and Larry Summers in dealing with the financial crisis as in “the proper role of government is to restore confidence in the financial institutions”. The second intended meaning of Suskind is how this small group of men manipulated, conned, scammed the President into following their policies and not the policies actually desired if not ordered by the President. Pretty strong stuff.

The book is a long rambling story telling of events from the long run for President, through the financial meltdown and the first years of the Presidency with an emphasis on the financial crisis but with excursions into health care reform and the auto bailout. It is so rambling that sometimes Suskind gets his facts mixed up as when he says health care insurers have revenues totaling $12 billion of the $2.5 trillion industry (page 193). Insurers profits alone exceed $12 billion! He sometimes loses the narrative as when he implies that Obama has already decided on an insurance mandate at the first health care summit where he gave the last word to insurance lobbyist Karen Ignagni. Then later in the book when health care reform again comes up for discussion it seems Obama has not decided on a mandate. And then Obama campaigned promising a public option. But here the problem may not be with the storyteller but with the man himself and this reader suggests this book is best seen as an imperfect study of the enigma that is our President.

After all, it doesn’t take a genius to figure out how these key players would act given their outsized egos, their personalities, and their history. Summers is a bully with highly toned rhetorical debating skills who is not embarrassed to dominate a discussion on subjects he knows nothing about. As Treasury Secretary in 1999 he was the moving force behind the Clinton administration dismantling of Glass-Steagall to allow Citibank to merge with Travelers Insurance bring Solomon and Smith Barney, two wall street investment banks into the Citi fold. He also made sure that the derivatives market would remain unregulated. These acts make Summers next only to Fed Chair Greenspan the most culpable enablers of the financial meltdown. It is equally revealing that Summers existed totally in the shadow of Bob Rubin so long as Rubin was Treasury Secretary for Clinton. Bullies know their place in the kicking order.

Geithner is a lifelong public servant who spend time in Washington and New York. At the New York Fed he was the shoe shine boy of wall street and the bankers who called him the “boy scout” behind his back. He and Bernanke together with former Goldman CEO ($750 million compensation) Hank Paulson engineered the bank rescue plan and further consolidation of finance as Wachovia, Washington Mutual, Bear Sterns, and Merill Lynch were swallowed up by the big banks. Geithner is not a public servant, he is a servant of Wall Street. It also turns out he is a tax cheat, failing to pay the IRS $34,000. Either he is cheating or he is incompetent, great choice! Incidentally, it seems Geithner’s father at the Ford foundation met Obama’s mother at least once in Indonesia. From Wikipedia;

From January 1981 to November 1984, Dunham (Barack’s mom) was the program officer for women and employment in the Ford Foundation’s Southeast Asia regional office in Jakarta. While at the Ford Foundation, she developed a model of microfinance which is now the standard in Indonesia, a country that is a world leader in micro-credit systems. Peter Geithner, father of Tim Geithner (who later became U.S. Secretary of the Treasury in her son’s administration), was head of the foundation’s Asia grant-making at that time.

Bernanke Lavishes free $14 Trillion on Wall Street

Ben Bernanke was touted as an expert on the Great Depression when he became Chairman of the Fed at the beginning of the meltdown. He was at all the merger and bailout meetings but we only now are learning the extent to which the Fed was secretly lending money to troubled institutions throughout the period. Recent Freedom of Information material acquired by Bloomberg is finally starting to shed some light on the extent of the exposure of the public in Fed lending to the banksters. The Fed has secretly loaned a peak of $1.2 Trillion to Wall Street and the banks including many European banks. Yes, public money has been loaned to European firms. That $1.2 trillion is the same total as all delinquent and foreclosed US home loans. Suskind put the figure at $3.5 trillion from 2007 to 2009. This brings the total Fed issuance to $14 trillion. If that money is used to purchase Treasuries at 3% this free money would yield the banks about $350 billion. So much for lessons on the Great Depression.

But the problem is not these characters who would be expected to act as they have. The important question is how did the President come to appoint them to positions where they could do more damage. Even Bernanke could have been replaced in 2009 when his first term ended.

President elect with Paul Volcker and Austan Goolsbee

Suskind characterized this question as Team A verses Team B. Team A, led by venerable Paul Volcker, was with Obama from the beginning of his candidacy and in-so-far as Obama’s superior knowledge of the workings and problems in the financial sector secured him election, it is thanks to Team A education and advice. On team A were Volcker, Austan Goolsbee, Robert Wolf (CEO of UBS and eyewitness of the meltdown meetings), Robert Reich, Stanley O’Neill, and William Donaldson. All expected significant rolls in the new administration, with Volcker as Treasury Secretary.

So how and why did Obama go with team B led by Geithner and Summers? We don’t have a clue. Byron Dorgan, Senator from North Dakota put it most eloquently; “You’ve picked the wrong people…I don’t understand how you could do this. You’ve picked the wrong people.” We voters all felt the same way. Where’s our change?

Daschle Master of Congress Left Behind

But Obama was not done yet. He needed to choose between longtime master of the senate, the low key, soft spoken, extremely tough Tom Daschle, and the brash, volatile, inexperienced, caustic, egotistical fourth ranked representative Rahm Emmanuel for his Chief of Staff, doorkeeper to the President. Tough choice right? We’ll go with the much hated in Congress Rahm. What is this man doing to himself? And even worse, Obama spent so much political capital getting Geithner appointed despite his personal tax problems that Obama loses entirely the services of Dacshle, who has a minor problem in failing to report the use of a lobbyist provide car while in Washington. Dacshle could have been confirmed before Geithner but not after. So Obama trades Dacshle for Geithner.

During this transition period, Obama is reading up on FDR who in his first hundred day in office passed the Emergency banking and Glass-Steagall acts, establishes the FDIC to insure deposits, created the Civilian Conservation Corps and the Tennessee Valley Authority. He passed the Farm Credit, Truth in Securities, and the National Recovery Acts, and others. The basis of the entire New Deal were in place within 100 days of FDR assuming office. While detractors point out that full recovery did not happen until WWII started, there was never doubt in Americans minds that the country was back on track early in 1933. Obama assumed office with no plans whatever; none; nada! So much for the legacy of FDR. And he appoints a team guaranteed to continue undermining the FDR legacy.

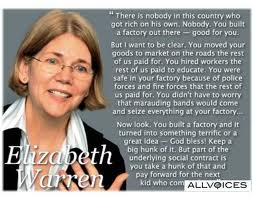

Two million people showed up in the freezing cold to watch the Obama inauguration and hope. Elizabeth Warren first met Obama at a campaign event in Chicago. Afterward Obama talked about being inside the bubble; “I haven’t been living in this bubble very long. I’m in it now, but not that long ago I had a real life.”

“And she (Warren) would wonder, replaying that last conversation in her head, if it was really about the bubble or the character of the man inside the bubble, and if in Chicago she had seem what she hoped to see, rather than what was really there.”

There are a lot of us wondering this same thing now.

Elizabeth Warren will not head Consumer Financial Protection Bureau

See Warren As TARP Oversight Chair Take on Geithner

You can’t run a policy based on a misdirection or a fiction. I don’t know what the president is thinking. I don’t see the president. He meets with bankers. He doesn’t meet with me. But if he’s involved in this at all, he’s got to know that his angry words at Wall Street, and their recklessness and dangerous incentives in compensation, about how they do their business in ways utterly divorced from what’s actually good for the economy – that he can’t just say that sort of thing and then just dump money in their laps and be credible. Tim and Larry’s whole plan is just like Argentina’s in the 1980s. There was this giant hole marked “Banks” and the government just dumped money in that hole, as much as they had, while they lied about it. That’s what Larry thinks, that the U.S. is Argentina.”

Elizabeth Warren, who was the driving force in establishing the Consumer Financial Protection Bureau to which Obama failed to make its first head and which was crippled at its inception by placing it in the Federal Reserve – toothless. This leads Suskind to another startling theme that links Obama, Summers, Emmanuel, and Geithner, their seeming inability to deal with women professional as equals. Suskind suggests that Summers was fired from the Presidency of Harvard not only because he suggested that women were genetically unsuited to science, but because during his tenure only four women were promoted at Harvard. Hillary, as a world recognized force of nature is the sole exception, viewed not as a woman, but as a power base. Suskind suggests that Christina Romer was given a “safe” ie. non threatening to Geithner and Summers appointment in a nod to gender equality.

Rubin Tanks Citigroup – Obama Wants to Dismantle Citi

Citigroup, under the leadership of Bob Rubin (himself now toxic in Washington) loaded up with toxic CDOs late in the game, was insolvent and ready to go under. Sheila Bair of FDIC tells the White House she is ready do an FDIC resolution of the bank, something the FDIC has been doing successfully since 1933 without a single mishap. Geithner panics because, of course, Citi is “too big to fail”, but Bair points out that at heart Citi is a bank, unlike the Wall Street firms they were dealing with in the past so of course the FDIC knows exactly how to resolve it.

The White House has been discussing the coming implosion from the start and Obama has centered on a “Japan or Sweden” theme. Japan repeatedly bailed out its financial institutions without insisting they clean up their toxic assets leading to the “lost decade” when Japan stopped growing economically. Sweden nationalized its banks, cleaned out the toxic assets, restructured and then closely moved to privatize the banks as they regained their feet. Sweden quickly recovered economically. Obama made it absolutely clear he favored Sweden.

Shiela Bair Ready to Resolve Citibank

When Bair announced her intention, Obama held a meeting at which he indicated his desire to restructure the entire banking industry. Having made his wishes known he left the meeting to have dinner with his family (dinner is more important than restructuring the financial system!) As soon as Obama leaves, Rahm says restructuring the entire industry is a non-starter because Congress will never approve the funds necessary. Note that he waits for Obama to leave before scuttling the entire plan. Obama comes back and Summers tells him they can’t afford the restructure the entire industry. Obama says, OK, we’ll start with Citi and when we show that works we can ask Congress for money for the rest of the industry. New decision, new plan. By this time Summers and Romer are in favor of the restructuring.

Geithner is terrified of restructuring Citi and has Treasury working feverishly on bank stress tests as an alternative to determine the real state of health of the industry. Industry insiders roll their eyes because the big unknown of course are the extent of toxic CDOs which are usually kept off the books to deceive investors and regulators and will not be uncovered by stress tests. Geithner simply wants to buy time and is determined to pump money to shore up confidence. He never seriously considered a resolution of citibank.

Bizarrly, Shiela Bair, government’s only expert on the resolving of banks is never consulted. Summers and Romer seem to think the ball is in Geithner’s hands but unknown to them, Geithner uses the excuse that the FDIC is too leak prone to discuss the possible restructuring of Citi. Geithner is, of course, doing nothing to plan for Citi’s restructure. When Obama asks how the plan is coming Geithner only talks about stress tests. Geithner is directly defying the express wishes and orders of his President. Nothing happens and Citi is never restructured. Bair is never brought into the loop. Welcome to Japan (or are we now Argentina) – so long Sweden. Geithner keeps his job as Treasury Secretary after monumental insubordination.

After this, Summers felt free to “re-litigate” every decision Obama thought he had made. Obama finds himself facing the same decisions over and over. More insubordination.

What is happening here is what seems increasingly to happen to Presidents, both Republican and Democratic, they are being managed by the staff that is supposed to support and implement their wishes. Only the President is elected by the people and only he has the mandate to govern. But in the modern Presidency including Clinton, W, and Obama, the staffs have taken the central policy development role and have their own constituencies. This has been true of three Treasury Secretaries to three Presidents; Rubin under Clinton, Paulson under W, and Geithner under Obama. Who do these guys work for and who do they serve? Certainly not their Presidents. The isolation is increased with a Summers who controls what the President sees and who he hears and with Rahm who arbitrarily dictates what is legislatively possible. Generally nothing is said to be possible. A President who can assemble two million citizens on the Washington Mall can pass any legislation he wants to, at least for a while. And it was Rahm’s job to figure out how to pass the President’s wishes into law, not to tell what can’t be done. Dacshle would have figured it out. So who is Obama and why has he allowed all this to happen – not happen.

Volcker reflects on Obama;

I think Obama understands everything intellectually, very easily, near as I can see. What we don’t know is whether he has the courage to follow through. He understands it, but does he feel it in the belly? I don’t know.

Volcker was vehemently oppossed to Gethner’s stress test idea because it puts the government into the position of choosing winners and losers. Finally fed up, Volcker agreed to appear before Barney Frank’s committee to give his opinion and Volcker pulled no punches. Glass-Steagall needed to be restored;

The point is not only the substantial risks inherent in capital market activities. There are deep seated, almost unmanageable, conflicts of interest with normal banking relationships – individuals, businesses, investment management clients, seeking credit, underwriting, and unbiased advisory services. I also think we have learned enough about the challenges and distractions for management posed by the risks and complexities of highly diversified activities.

Summers opined to many senior staff members in widely quoted terms;

We’re home alone. There’s no adult in charge. Clinton would never have allowed these mistakes.

Then there was the treatment of the many women on the staff. As Anita Dunn recalled;

This place would be in court for a hostile workplace…Because it actually fit all of the classic legal requirements for a genuinely hostile workplace to women.

Obama, Summers, Geithner, and Emmanuel are all implicated in creating this hostile workplace.

Early in his term Obama brings a group of Congressional leaders of both parties to the White House to discuss the budget. Out of nowhere, Obama blurts out to the Republicans present “I’m prepared to give you tort reform. What will you give me?” What does tort reform have to do with the budget? This leads one participant to think of the movie Dave, where an actor look alike is brought into the White House to impersonate a secretly comatose President.

Obama assembled a team, led by M&A banker Steven Rattner, to deal with the auto industry crisis. So it is no surprise the team approached the auto industry totally from the perspective of a financial acquisition where 17 out of 20 firms end up being liquidated. The team called saving Chrysler rather than liquidating it and collaterally destroying the suppliers and dealers as a side effort of liquidation “a close call”. No one in the room was looking out for the worker, the industry retiree, the jobs.

For the next 200 pages, Obama and the white house virtually disappear – in a book about the presidency!

The banks and Wall Street are back to normal behavior with over $35 trillion in outstanding credit default swaps by 2011. The repo (daily refinancing of off the books securities) is fully up and running. Profits are at record levels as are compensations to the top executives. Then the Goldman scandal revealed by the SEC that hedge fund manager John Paulson was creating derivatives designed to fail that Goldman could then sell to suckers, like German Banks while they purchased CDS insurance against these same CDOs, reigniting the public furor at wall street’s unethical and illegal behavior. Goldman made $3.7 billion in 2007 from Paulson’s hand crafted weapons of mass destruction. This was on top of the previous disclosure that large amounts of TARP funds had flowed through AIG directly to Goldman as 100% payment for CDS insurance claims. No haircut for Goldman!

Larry Fink $9 trillion toxic asset cover guy

Meanwhile Treasury handed off $9 trillion in toxic troubled mortgage assets to Blackrock to manage. $5.5 trillion came from Freddie and Fannie and the rest came largely from the Lehman bankrupcty and from the AIG CDs insurance payouts. Blackrock was paid $300 million a year to manage these “assets”. Suskind doesn’t pursue this but the reader thinks this means that the government and the Obama administration are the direct owners of a heck of a lot of mortgages. How many houses are still occupied? Are restructured loans being offered? Are these loans being foreclosed on? What is the state of the paperwork on these loans? Are they fragments or tiers of CDOs or can whole mortgages be reconstructed? It seems there is a potential here to do a lot of good for people and the economy. It looks like Geithner and Treasury may be sitting on this toxic stuff just like Wall Street and banks so no one has to recognize the losses entailed.

The Dodd-Frank bank reform bill passes which promises to do nothing for bank reform. Even the Volcker rule has been neutered. Deriratives, those weapons of mass destruction, may be moved to separate subsidiaries but no clearinghouse and no exchange required. Obama, who was MIA during its development publicly praises the bill.

Gary Gensler, Scourge of Wall Street

Suskind spends some time on Gary Gensler, formerely of Goldman and now chair of the obscure regulatory agency Commodities Futures Trading Commission CFTC. As a condition of his senate approval Gensler had to promise Maria Cantwell (and Bernie Sanders) that he would push for derivatives to be traded through an exchange and with a formal clearinghouse.

He meets Voightman who ran Lehman’s mortgage finance arm and asks him when he knew the mortgages were in trouble. Voightman said that by August 2005 10% of mortgagees were failing to make their first payment. But he said Goldman saw mortgage underwriting standards deteriorate in 2004 and demand for CDOs skyrocketed. Goldman quickly realized someone was needed to take the short side or “downside” to assure the liquidity of these CDOs. “Goldman did that as fast as was humanly possible, and then some.” Goldman anticipated the financial collapse in 2004!

Gensler studlied Morgan Stanley’s financials and discovers they have an $80 billion derivatives book of which $55 billion is uncovered – un-collateralized; roughly 60%. Wall Street hasn’t changed its behavior at all. Digging further he came across figures from the Basel Committee on Banking Supervision whose conclusions supported that Morgan was not alone. Goldman, JP Morgan, insurance companies, and others have an over the counter derivatives book of $400 trillion of which more than half is unsecured or un-collaterized – there is nothing in reserve when these unregulated derivatives blow up. The next financial collapse is primed and ready.

Gensler finds a former colleague is working for Senator Blanche Lincoln and works with them to develop a bill to require regulation of derivatives. Her bill passes committee. The bill fails, Lincoln attempts to attach it to other bills but it ultimately disappears. Gensler is called the most dangerous man in Washington by Wall Street, he receives death threats, one threatener is arrested, and Gensler is assigned a security detail. Wall Street plays hardball to protect their sacred compensation which largely depends on unregulated derivatives. Gensler’s initiatives missed Dodd-Frank but Gensler is still out there trying to reign in those derivatives. Obama is MIA.

Bernanke’s first term ends in 2009 and Geithner recommends that Obama retain him. Summers, who thought he had an understanding with Obama that he would be the next Fed Chairman, is furious. He acts out like a little kid, throwing tantrums, and demanding new perks if he is to stay. He fortunately decides to leave. At the end we go through the complete staff reorganization at the White House. Only Geithner remains, but alongside Bernanke, that is all Wall Street needs. Imagine Geithner’s payoff once he leaves office in five years – unless the next financial meltdown has already begun.

Don’t Prosecute Wall Street or Bank Executives

Missing from the book are some pretty significant details. Attorney General Eric Holder is mentioned once as a member of the committee to select a VP. Occupy Wall Street (and Michael Moore) wonder why there have been no arrests or prosecutions of Walls Street “banksters” for their frauds leading to the financial meltdown. The executives themselves maintain that they broke no laws, but their attorneys, as reported by Suskind, are actually advising them that their activities “would be hard to prosecute” – slightly different than not breaking any laws. The book also reports someone suggesting that a few hundred “perp” walks would do wonders to reform the behavior on Wall Street. The answer has to be that Obama or his administration has instructed Holder that there will be no prosecutions of Wall Street or the bankers, under the cover of “confidence”. This would be consistent with Summer’s and Geithner’s “do no harm” wimpy non approach to financial reform. (Just paper over the problem with money!) This is a major and key oversight for Suskind. Criminal prosecutions would have changed the entire dynamic for this wimpiest of administrations.

The SEC should have also figured in this book even if only to call attention to their lack of action. Finally (after the book is published) the SEC has announced fraud prosecution against top executives in Fannie Mae and Freddie Mac, which are both under control of the government. There is unlikely to be criminal charges coming out of this SEC action. To see how regulators are supposed to act in a financial crisis see William Black.

The environment doesn’t even get a mention in this book it is so far down the list of Obama’s priorities. We know he embraces “drill baby drill” and was only momentary delayed by the BP Gulf disaster from approving new drilling leases (including some to BP). We know he overrode the EPA to soften air control standards. We know he is delaying action of international climate change carbon emissions commitments. We know he delayed a decision on the oil sands pipeline as a political expediency to get him through the next election before he has to make a choice. The Republicans are attempting to force him into a decision before the election knowing any decision will anger some of Obama’s constituents. Wimp-in-chief.

We know Obama is secretly rebuilding the nuclear arsenal at enormous public expense. We know that Obama ordered that there would be no prosecutions of the W officials for war crimes. “Let’s Look Forward. Move on.” Obama promised to close Guantanamo, then failed to do so. Obama promised to end torture, then tortures American citizen Bradley Manning in America. Not satisfied with torture, both Obama and Biden publicly declare Manning guilty of leaking the secrets, declare him a terrorist, leaving a fair trial for Manning impossible anywhere.

Adding to this outrage, Obama becomes “Assassin-in-Chief” ordering Osama Bin Laden killed illegally by having the military violate the territory of Pakistan to shoot, extract, and then dispose of the body at sea. What happened to due process, the rule of international law, the example of Nuremberg and Japan after WWII. He then expands on this assassin persona by killing American Citizen Anwar al-Awlaki in Yemen. He also assassinated al-Awlaki’s innocent 16 year old American son. Who is this Harvard trained law professor guy?