High Frequency Extortion

Flash Boys, A Wall Street Revolt, Michael Lewis, 2014

This book is about the fast changing character of market exchanges, the big banks, and their collusion with high frequency traders that have made trading into a totally opaque dive into the shark tank. The book was rushed to market with incorrect words, syntax, and spelling problems, but it is still worth reading.

Wall street has undergone a technological revolution into electronic trading led first by NASDAQ . A few years ago there were three stock exchanges plus the Chicago futures market where an individual stock could be listed on only one exchange. Now there are countless exchanges and stocks can be traded on any of them. After September 11, 2001 there was an exodus of the markets from Manhattan to the suburbs of New Jersey. In 2007 the SEC implemented Reg NMS which required brokers to find the best market price for investors. This new regulation was in response to a growing epidemic of front running in the markets, but its implementation actually increased the opportunity for front running because brokers were required to pass their orders to more exchanges leading to more opportunities to front run. Wikipedia defines and explains front running as follows:

Front running is the illegal practice of a stockbroker executing orders on a security for its own account while taking advantage of advance knowledge of pending orders from its customers. When orders previously submitted by its customers will predictably affect the price of the security, purchasing first for its own account gives the broker an unfair advantage, since it can expect to close out its position at a profit based on the new price level. The front running broker either buys for his own account (before filling customer buy orders that drive up the price), or sells (where the broker sells for its own account, before filling customer sell orders that drive down the price).

As if things were not complicated enough many financial institutions have created something called dark (or black) pool as a total alternative to the mess with the public exchanges. Again Wikipedia defines a dark pool as:

In finance, a dark pool (also black pool) is a private forum for trading securities that is not openly available to the public. Liquidity on these markets is called dark pool liquidity.The bulk of dark pool trades represent large trades by financial institutions that are offered away from public exchanges like the New York Stock Exchange and the NASDAQ, so that such trades remain confidential and outside the purview of the general investing public. The fragmentation of financial trading venues and electronic trading has allowed dark pools to be created, and they are normally accessed through crossing networks or directly among market participants via private contractual arrangements.

One of the main advantages for institutional investors in using dark pools is for buying or selling large blocks of securities without showing their hand to others and thus avoiding market impact as neither the size of the trade nor the identity are revealed until the trade is filled. However, it also means that some market participants are disadvantaged as they cannot see the trades before they are executed; prices are agreed upon by participants in the dark pools, so the market becomes no longer transparent.

The main focus of this book is high frequency trading defined again in Wikipedia:

High-frequency trading (HFT) is a type of algorithmic trading, specifically the use of sophisticated technological tools and computer algorithms to rapidly trade securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second.

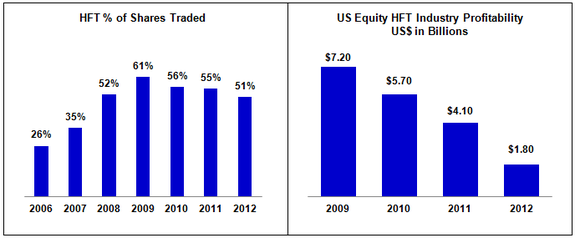

As of 2009, studies suggested HFT firms accounted for 60-73% of all US equity trading volume, with that number falling to approximately 50% in 2012.

High-frequency traders move in and out of short-term positions aiming to capture sometimes just a fraction of a cent in profit on every trade. HFT firms do not employ significant leverage, accumulate positions or hold their portfolios overnight. HFT firms make up the low margins with incredible high volumes of tradings, frequently numbering in the millions.

HFT may cause new types of serious risks and dangers to the financial system. Algorithmic and HFT were both found to have contributed to volatility in the May 6, 2010 Flash Crash, when high-frequency liquidity providers rapidly withdrew from the market.

High Frequency traders trade with perfect information and their speed advantage assures that their trades incur no risk of loss. HDTs never lose money unless their algorithms or machines blow up.

Personalizing this mess, Lewis focuses on Brad Katsuyama a young trader at the Royal Bank of Canada who, in 2006 noticed that whenever he placed an order, the price instantly changed. Welcome to the brave new world of trading. What Brad discovers is that HFT and other financial institutions act on his orders before the actual traders can do so. These leaches co locate their equipment with the exchanges and pay fortunes for fast communications links. To gather information they troll tiny orders for a wide variety of stocks and when these tiny orders get a nibble they determine by the stock involved and the trader that this may be a part of a large trade and they rush throughout the exchanges to beat the traders to the stocks being offered. Once owned the front runners can change the price and sell them back.

Katsuyama eventually leaves RBC to start his own “honest” exchange, IEX. The trick is to ensure that his exchange IEX support only the few most common trading types and to guarantee that all connections to IEX are slow enough to prevent front running. If you trade exclusively on IEX, HFT and other financial institutions cannot front run your orders. IEX is new and its survival and success were unknown at publication time. Goldman Sachs placed its first large order on IEX on Dec 19, 2013 which IEX took as a very hopeful sign. Because stocks seldom trade exclusively on IEX, HFT and other financial institutions systematically troll IEX for information that they can exploit on other exchanges. Life goes on as usual.

Sergey Aleynikov and his attorney Kevin Marino

Lewis includes the side story of Sergey Aleynikov charged by Goldman Sachs with stealing proprietary software when he left the company. Sergey was acquitted on appeal but, for this reader, the interesting details concerned the use of open source software defined again by Wikipedia:

Open-source software (OSS) is computer software with its source code made available and licensed with a license in which the copyright holder provides the rights to study, change and distribute the software to anyone and for any purpose. Open-source software is very often developed in a public, collaborative manner. Open-source software is the most prominent example of open-source development and often compared to (technically defined) user-generated content or (legally defined) open-content movements.

Open source software is often used by developers to shorten their development time and to produce better software. The trick is to find the right software on the internet that can be modified for the user’s purposes. Sergey’s stolen software was modified open source software that, according to the license of its use must remain open and the modifications made available to the public open source community. Goldman Sachs removed the license notice from the software so it was actually Goldman Sachs, not Sergey who illegally stole the software.