Inside Edge

Black Edge, Inside Information, Dirty Money, and the Quest to bring down the Most Wanted Man on Wall Street,Sheelah Kolhatkar, 2017

We previously looked at high frequency traders and how they get their edge to make massive questionable money on the market using High Frequency Extortion. This book is a look at hedge fund traders who rely on illegal inside information to make massive profits on Wall Street.

Stephen A. Cohen

At the center of this story is Steve Cohen and his solely owned hedge fund SAC Capital, a $15 Billion hedge fund of which $10 Billion is Cohen’s own money. It is the story of the FBI, using RICO (organized crime) laws to go after hedge funds, the SEC, and the New York Attorney General’s office.

The US Justice Department was unable or unwilling to bring criminal charges against any senior Wall Street executive for their role in the financial collapse of 2008. Instead they levied “slap on the wrist” fines. There is a widespread believe in government that Billionaires are untouchable.

Raj Rajaratnam

The biggest success in the book is the arrest and conviction of Raj Rajaratnam and the closure of his Galleon Group fund. They found $55 million trade profits from 11 trades involving inside information. By comparison, a single pharmaceutical deal netted SAC Capital more than $250 million in profits, yet Steve Cohen got a small fine, closed his fund for two years and went on trading, presumably relying on inside information he calls Black Edge. Cohen was free to continue to invest his own $10 Billion and in less than a year he recovered the amount of his “slap on the wrist” fine. He is expected to open a new fund to outside investors.

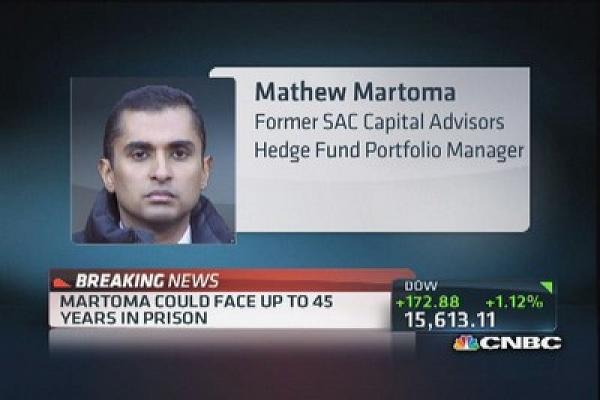

Two of Cohen’s fund portfolio managers were tried, convicted and sentenced to long jail terms but one of those convictions was overturned on appeal. The overturn greatly increased the government’s difficulty in bringing insider trading cases and the New York Attorney general had to drop a number of pending cases. The government expected one or both of the managers to enter a plea bargain and implicate Cohen but neither did. Maybe Cohen promised some future reward or the fact that SAC Capital paid for the defense explains why neither entered a plea bargain. Mathew Martoma is the only successful criminal conviction of SAC Capital.

One reason for the difficulty to bring a case against Cohen is the way he organized SAC Capital, like a spider web with Cohen the spider at the center. It is well understood by anyone working for Cohen that he expects them to collect “black edge” exclusive inside information but Cohen has never explicitly stated this. The inside information reaches him in the form of simple buy or sell recommendation with a level of confidence index from 1 to 10. The higher the number the more certainty Cohen has that the recommendation is based on illegal inside information. Cohen never sees the information or knows where the information came from, at least in theory. Cohen also has instant feedback on any trade entered into by any of his portfolio managers. He uses these trades to confirm the confidence level numbers and can then enter his own trades based on all this information. In the case of the pharmaceutical deal, an email containing the phase II drug trial results was sent to Cohen before the official announcement but the government was unable to find this email. They also have phone records of calls during the key periods of the big trades but these are all but useless without the actual phone conversations. The FBI got phone tap orders for Cohen but on the wrong house at the key times. Once Cohen was tipped on the Pharmaceutical trial results he was able to sell a $1 billion position in the two Pharmaceutical companies and to take massive short positions in both companies all without alerting anyone else on Wall Street what he was doing. For this level of activity to go unnoticed is really remarkable.

Like the subprime financial meltdown and the lack of government corrective action, so there is little hope that trading on inside information is likely to end soon. In fact marketing inside information is now its own big industry with organizations like Primary Global Research (PGR) matching those having access to inside information with investors willing to buy that information.

Cohen has a rule that you never enter into a trade if Goldman Sachs is on the other end. For any ordinary trader trying to manage his own personal portfolio the presence of illegal “edge” in the markets makes almost any trade too risky to enter. To inside traders the rest of the trade world are suckers waiting to be fleeced.