The Federal Reserve – An Unaccountable Central Bank for Wealthy Risktakers Only – Waiting for the Global Meltdown

Wednesday, March 30th, 2022The Lords of Easy Money; How the Federal Reserve Broke the American Economy Christopher Leonard, 2022

<> <> <> <> Christopher Leonard

<> <> Tom Hoenig <> <> <> <> <> <> Ben Bernanke

Life at the zero bound pushes banks way down the yield curve. What does a bank have to lose? A risky bet beats nothing. And this is not just a side effect of keeping rates at zero, “That’s the whole point.” Hoenig (Tom Hoenig was the long time president of the Federal Reserve Bank of Kansas City) explained many years later. “The point was to get people willing to take greater risk, to get the economy started. But it also allocated resources. It allocates where that money goes.”…When cash is pushed out onto the yield curve, it leads to the second big problem that Hoenig warned about in 2010: something called an asset bubble. The housing market that collapsed in 2008 was an asset bubble. The dot-com stock market crash of 2000 was the bursting of an asset bubble.

One of his (Ben Bernanke) central ideas was that the Fed hadn’t acted boldly enough back in the 1930’s. The central bank had actually worsened the Depression by tightening the money supply, The solution, Bernanke believed, was to to be as aggressive as possible after a crash. He had spent many years thinking up new ways that the Fed could boost economic growth even after pushing interest rates to zero. He didn’t see the zero bound as an inviolable limit, but just another data point.

To execute quantitative easing, a trader at the New York Fed would call up one of the primary dealers, like JP Morgan Chase, and offer the buy $8 billion worth of Treasury bonds from the bank. JP Morgan would sell the Treasury bonds to the Fed trader. Then the Fed trader would hit a few keys and tell the Morgan banker to look inside their reserve account. Voila, the Fed had instantly created $8 billion out of thin air, in the reserve account, to complete the purchase. Morgan could, in turn, use this money to buy assets in the wider marketplace.

Starting in November (2010), the Fed traders did this transaction over and over again until they had created several hundred billion dollars inside the Wall Street reserve accounts…The primary dealers were not just selling the Treasury bills and mortgage bonds that they happened to have on hand…Instead the Fed set up a conveyor belt of sorts, which used the primary dealers as middlemen. The conveyor belt began outside the Fed, with hedge funds that were not primary dealers. These hedge funds could borrow money from a big bank, buy a Treasury bill, and then have a primary dealer sell that Treasury bill to the Fed for a profit. Once the conveyor belt was up and running, it began magically transforming bonds into cash. The cash didn’t stay safe and sound inside the reserve accounts of primary dealers. It started flowing out into the banking system, looking for a place to live.

He (Hoenig at the FOMC meeting in Sept. 2010) pointed out that the deep malaise in American economic life wasn’t caused by a a lack of lending from banks. The banks already had plenty of money to lend. The real problem lay outside the banking system, in the real economy where the deep problems were festering, problems that the Fed had no power to fix. Keeping interest rates at zero, and then pumping $600 billion of new money into the banking system–money that had nowhere to go but out into risky loans or financial speculation–wasn’t going to help solve the fundamental dysfunction of the American Economy.

During the 1980’s, Hoenig and his colleagues in Kansas City were left to sort out the long-term problems the Fed’s short-term thinking created during the 1970s. The biggest mess they cleaned up was the failure of Penn Square, a bank in Oklahoma that had extended a chain of risky energy loans during the 1970s. When Penn Square failed, it almost took down the entire U.S. banking system with it. It also illuminated a second important pattern that would harden in the coming years. The Fed didn’t just stoke asset bubbles. It found itself on the hook to bail out the very lenders who profited most off a bubble as it rose. Some banks, the Fed was about to discover, had grown too large and too interconnected to fail.

Around 2014 or 2015, (Vicki) Bryan (corporate analyst) noticed that she could bring new revelations (about corporate misbehavior) to the market, but it didn’t seem to matter anymore. “It’s been a result of what the Fed stated to do in 2010, and continued to do later,” she said. “You’ve got an artificial bottom, and the higher part of that bottom is set by the Fed. So you can’t lose in this market. And if you can’t lose, it’s not really a market,” Bryan said.

In 2008, the market imploded thanks to an exotic debt product called the collateralized debt obligation, or CDO. The CDO was a package of home loans (or derivatives contracts based on home loans) stacked together and sold to investors. The CDO made the housing crash possible by creating a seamless assembly line that allowed mortgage brokers to create risky subprime home loans that were quickly packaged and sold to investors, which in turn allowed the mortgage brokers to extend yet more new loans. At that time, the lowly CLO (collateralized loan obligation) was the undernoticed stepchild of the debt markets. There were only about $300 billion worth of CLOs during the Global Financial Crisis of 2008, while in 2006 alone about $1.1 trillion of new CDOs were issued. But the important thing about CLOs was that they didn’t suffer nearly the losses that CDOs suffered.

The pension funds had been settling on a low return from safe corporate bonds, because those bonds were standardized…The bonds were regulated by the SEC and traded on exchanges…The CLO solved this problem. It would standardize leverage loans in ways that make the pension funds feel safe…This meant that a pension could order CLO chunks,…picking between the AAA, mezzanine, and equity slices of the package.

Financial engineering was key to Rexnord’s strategy. Rexnord, like any corporation, responded to the environment in which it operated. And that environment, starting in 2012, was dominated by the influence of ZIRP (zero-interest-rate-policy)…The management team’s biggest maneuvers had to do with leveraged loans and rising stock prices rather than conveyor belts or ball bearings…He (Rexnord employee John Feltner) believed,…that a job at Rexnord might provide him a narrow pathway to a stable middle-class life. All the financial engineering encourage by ZIRP was supposed to make that belief come true. The company owed $1.9 billion and it paid $88 million on interest costs in 2015, which was more than the $84 million it earned in profits…in 2015 Rexnord’s board of directors authorized Adams and his team to buy back $200 million in stock. In 2016, the company bought back $40 million of its own stock. In 2020, the company …bought back another $81 million…In 2016, he (Adams) was paid $1.5 million but the following year he was paid $12 million, mostly in stock awards, and in 2018 he would earn $6 million.

But Rexnord’s stock buybacks were seen by the Fed, as a means to an end. It was OK if CEOs used debt to help engineer multimillion-dollar paydays, as long as the prosperity was eventually dispersed through the “wealth effect” (Cosmic Lie) to neighborhoods like the Feltners’…Rexnord had decided to close the ball-bearing factory and move its production to Monterrey, Mexico. (Feltner lost his job.)

By the end of 2018, the U.S. market for CLOs was about $600 billion double the level a decade earlier…The value of the Dow Jones Industrial Average rose by 77 percent between 2010 and 2016. One hedge-fund trader…described the frothy stock market of 2016 as being like the crowded deck of the the Titanic as it sank…It was getting crowded because people had nowhere better to go.

This money flowed out into the system, and it pushed all the major financial institutions to search for yield. Many wall street traders saw clearly what was happening, and they developed a nickname for it: “the everything bubble.”

By 2016, they (negative interest bonds) accounted for 29 percent of all global debt. About $7 trillion worth of bonds carried negative rates…Bond investors were so desperate to find a safe haven for their cash that they willing to pay a fee to governments like those of German and Denmark to safeguard it.

Hoenig said “You had seven years of basically zero-interest rates. Now what happens in an economic system over seven years. The entire market system develops a new equilibrium–around a zero rate. An entire economic system. Around a zero rate. Not only in the U.S. but globally. It’s massive. Now think of the adjustment process to a new equilibrium at a higher rate. Do you think it’s costless? Do you think no one will suffer? Do you think there won’t be winners and losers?”

Excess bank reserves were about 135,000 percent higher than they had been in 2008. The Fed’s balance sheet was about $4.5 trillion, about five times its level in 2007. Interest rates had been pinned at zero for nearly seven years.

In response to the 2020 Covid epidemic, congress passed the CARES act worth $2 trillion in relief funds:

People who owned businesses were given tax breaks worth $135 billion, meaning that about 43,000 people who earned more than $1 million a year each got a benefit worth $1.6 million. By and large, these billions of dollars were quietly absorbed into corporate treasuries and personal bank accounts around the county. The wildly unequal distribution of money was not made public until months later, after The Washington Post won an open-records lawsuit that made the information public.

The market hit its low point in mid-March, when the Treasury market collapsed. But between that day and middle of June–in just three months–the market’s value surged by 35 percent. By then, stocks were trading at the same value they had when restaurants, movie theaters, hotels, and cruise ships were operating at full capacity. The average monthly returns on leveraged loans were restored as early as April. By August, so many new investment-grade bonds were issued that the previous record, set in 2017, was broken.

The bailout of 2020–the largest expenditure of American public resources since WWII–solidified and entrenched an economic regime that had been quietly and steadily constructed, largely by the Federal Reserve, during the previous decade. The resources from this bailout went largely to the entities that were strengthened by the policies of ZIRP and QE. It went to large corporations that used borrowed money to buy out their competitors. It went to the very richest of Americans who owned the vast majority of assets; it went to the riskiest of financial speculators on Wall Street, who used borrowed money to build fragile positions in global markets; and it went to the very largest U.S. banks, whose bigness and inability to fail was now an article of faith.

And all of this happened at a moment when Americans were more distracted, more beleaguered, and more financially distressed than at any moment in modern history. It was difficult to even comprehend the impact of what had happened. But the impact would make itself visible in the months, years, and likely decades to come.

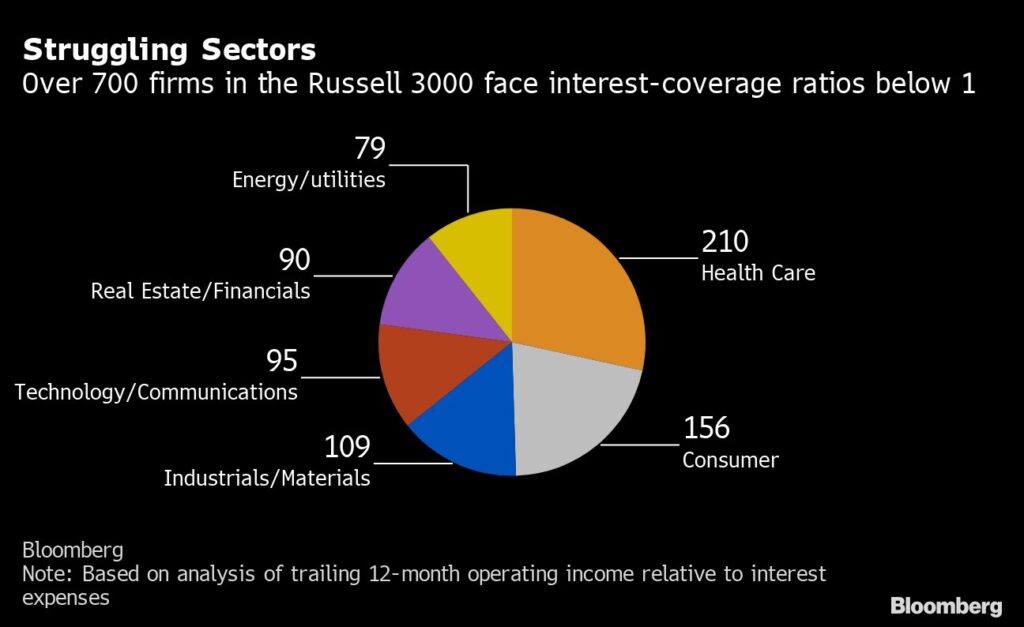

By the end of 2020, companies issued more than $1.9 trillion in new corporate debt, beating the previous record that was set in 2017…A zombie company was a firm that carried so much debt that its profits weren’t enough to cover its loan costs. The only thing that kept zombie companies out of bankruptcy was the ability to roll their debt perpetually. During 2020, nearly two hundred major publicly traded companies entered the ranks of the zombie army…These weren’t just marginal or risky firms, but included well-known firms like Boeing, ExxonMobil, Macy’s, and Delta Airlines.

In many important ways, the financial crash of 2008 had never ended. It was a long crash that crippled the economy for years. The problems that caused it went almost entirely unsolved. And this financial crash was compounded by a long crash in the strength of America’s democratic institutions. When America relied on the Federal Reserve to address its economic problems, it relied on a deeply flawed tool. All the Fed’s money only widened the distance between America’s winners and losers and laid the foundation for more instability. This fragile financial system was wrecked by the pandemic and in response the Fed created yet more new money, amplifying earlier distortions. The long crash of 2008 had evolved into the long crash of 2020. The bills had yet to be paid.

Christopher Leonard is also the author of Kochland