The Kochs – Hypocritical Libertarians

Kochland; The Secret History of Koch Industries and Corporate Power in America, Christopher Leonard, 2019

The Fred C. Koch Family

Fred C. Koch died Nov 17, 1967 Mary R. Koch died December 21, 1990 Charles Koch died Aug 23,2019.

In a 1974 speech (Charles) Koch attacked the entire narrative behind the New Deal (based on Keynesian Economics), claiming that Roosevelt’s legislation was not, in fact, in response to a lack of federal-level regulation. Koch said that when the New Deal was passed, the economy was already “polluted by massive governmental manipulations of the money supply.”…The business community needed to wage a long-term campaign that would change the way Americans thought about the markets and the role of government (Hayek, Mises, Friedman). Koch said that the campaign should have four elements; 1) Education; 2) Media outreach; 3) Litigation; and 4) Political Influence.

Based on his long term vision, Koch founded the Cato Institute, contributed to the Heritage Foundation and other right wing think tanks; rebuilt the law and economics departments of George Mason University near Washington in the image of the Chicago school, and created the Mercatus Center another free market think tank. This center offered free seminars to more than 4,000 federal judges from all 50 states. Koch was central to the creation of ALEC, the American Legislative Exchange Council, which writes right wing laws and pressures state legislatures to pass them. Koch is behind the Americans for Prosperity lobby that was central to defeat of the Obama era cap and trade legislation in 2010, the only serious effort by congress to limit carbon emissions. In the 2010 midterm election, the Republicans gained control of the house and senate, in large part due to the emergence of tea party candidates and Koch’s Americans for Prosperity efforts.

Koch Industries was to benefit enormously from Federal Action, particularly from the Clean Air Act of 1970. Refineries already operating in 1970 (Koch had two) were “grandfathered” in to the era of clean air regulation. The unintended consequence of this legislation was to halt the construction of new refineries, assuring that no new competition would enter the business. Existing refinery owners immediately started gaming the act; for example companies could be exempted if curbing pollution would be unreasonably expensive. This assured that new technologies would never be implemented in the existing refineries. The EPA was to enforce the New Source Review program which prohibited new refineries from entering the game. The last refinery built in the US was completed in 1977. The EPA needed to rely on state regulators to enforce the New Source Review and these state regulators were simply outgunned and overwhelmed by the giant refinery corporations. Koch’s two refineries were able to increase their capacity more than ten fold and were able to introduce new outputs and products at will. Much of this expansion was achieved without first obtaining permits that would have limited pollution from the plants. Koch refused to invest in suggested new pollution control measures.

Pine Bend Refinery Rosemount, Minnesota

In mid 1996 a sour water stripper that limits the amount of ammonia that was pumped into the wastewater treatment plant ceased operating properly. Repairing the stripper would require shutting down the refiner which Koch refused to do. Instead Koch flushed the ammonia rich waste into large detention pools on the far end of the refinery. When these filled they began spraying the contaminated water onto the surrounding wetlands and fields. In January 1997, Heather Faragher, The only employee trained in waste water management at Koch’s refinery but without the authority make changes at the refinery, told the Minnesota Pollution Control Agency, which was responsible for enforcing federal EPA standards, everything that Koch had been doing at the refinery. in 1998 the MPCA fined Koch $6.9 million for pollution. Federal criminal charges in 1999 resulted in a criminal fine of $6 million, $2 million to the County Park system. Koch also agreed to pay the EPA a $3.5 million fine. Similar events happened at Koch’s Texas refinery, causing Charles Koch to initiate a new program to assure that Koch was in compliance with all state and federal regulations (100% compliance, 100% of the time). He hired a group of regulatory compliance attorneys locating them at company headquarters in Wichita Kansas with the authority to force all company divisions to comply with regulations and with the authority to shut facilities down if necessary. He was driven to this measure to avoid future big fines, to protect Koch’s now tarnished reputation, and to prevent state and federal officials from inspecting and investigating his operations. Privacy and secrecy are Charles Koch’s highest priorities.

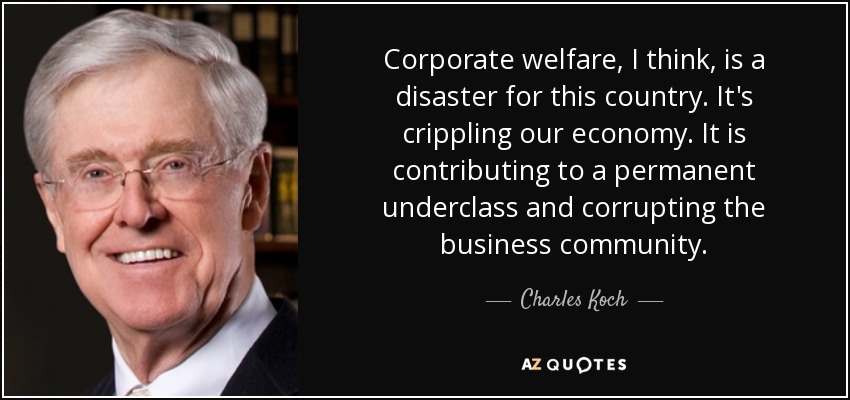

A big disappointment in this 600 page book is the failure to address the extent to which Koch benefits financially from direct government subsidies. The topic receives one short mention with no figures of the scale of corporate welfare or crony capitalism enjoyed by Koch. Charles Koch often speaks about his opposition to government subsidies but there is no evidence in this book that Koch has ever turned down a single subsidy. The book does mention that fracking was developed largely due to government subsidies and Koch indirectly benefited as fracking increased the production of oil and natural gas so that the US is now energy independent. One would dearly love to know the extent to which Koch’s remarkable success was due to direct government subsidies.

The fossil fuel industry has always depended on trading, the buying of crude oil, natural gas, etc. and on selling refined or manufactured products. Historically this trade has not been done using established commodity markets. Koch established a separate trading division located in Houston. Charles Koch insisted that his traders have the best available information including the best weather forecasts. Koch invested heavily in computers and developed elaborate models of the relevant markets. Central to the success of Koch trading was the availability of inside industry information which can be used freely and legally in Koch’s markets. Market volatility is what drives profits in trading and Koch’s traders became expert in exploiting volatility. In the cold winter of 2000, one trader placed large bets on the volatility of natural gas prices and earned Koch $75 million. The trader’s base salary was $60,000 and he earned $4 million in a bonus. Koch keeps a close leash on its traders and knows on a day to day basis company exposure to its trader’s bets. Unlike banks, wall street firms and insurance companies, Koch has never experienced unexpected losses from a rogue trader. In 2000, as Clinton was leaving office, his administration passed the Commodity Futures Modernization Act, leaving the market for derivatives unregulated and in the dark. Thus Clinton set the stage for the 2008 subprime mortgage crisis. This book explores how fossil fuel industry traders quickly learned and adapted to this new age of unregulated financialization. We think of Wall Street, the banks, and the insurance companies, but the fossil fuel industry reaped enormous profits from exotic and dark trades.

How Koch Became an Oil Speculator Powerhouse

Companies like Enron and Koch all engaged in illegal trading activity, best exemplified by California’s electric utility deregulation fiasco that started in 2000. ALEC was instrumental in getting the disastrous neoliberal bill passed in 1998. The New Deal Era public utilities system for electrical power was replaced by a radical new system. The existing utilities retained their geographic monopolies with set maximum electric rates, but they were stripped of their generators. Power generation was privatized and the utilities were required to buy power on a daily basis. An emergency state agency was created to buy electricity when the markets failed. A massive daily trading system emerged. The new system was quickly overrun by unusually hot weather. The scale of Koch’s illegal trading activities in California electric power were dwarfed by the scale of Enron and other huge energy companies and largely escaped being tarnished further by its illegal trading. Charles Koch’s 100% compliance order somehow did not include the trading division. Enron’s fraud and illegal activities forced it out of business in 2007.

California Electricity Crisis of 2000-2001

Charles Koch was a keen student of the latest management theories. Early in his career, he adopted the teaching of Edward Deming who revolutionized Japanese manufacturing practices after WWII. His typical management hire was a young graduate of a midwestern university often with an engineering degree and often someone raised on a farm with midwestern work habits. Charles Koch believed he could educate the young graduates to his philosophy and new hires spent hours in seminars and training. The new hire would then be assigned a job and his performance closely watched. If he was successful, he would then be reassigned to another position that might be totally alien to the experience and training of the employee. They might find themselves moved from a refinery to a trading desk where a whole new set of skills is required. If successful there, the employee might be moved to another position, maybe in fertilizer or pipelines or most anything. If the employee does not succeed in their new assignment they are terminated from Koch. Its a bit like the father that throws his child in the deep water to see if they sink or swim. In spite of this style of management, employees at Koch, if they succeed, seem extremely loyal to Charles Koch and enjoy long careers. In 1969, two years after Charles Koch became CEO, Laurence J. Peter published a book describing what became known as the Peter Principal. Organizations continue to promote their workers until they reach a point where they are no longer able to successfully perform the functions required by their position. This book makes no mention of the Peter Principal but Charles Koch, whether he knew the principal or not, seemed to embrace it and used advancement within Koch to test and challenge his employees until they break at which point they are removed.

In 1987, an investigative report published in the Arizona Republic charged that the oil companies were stealing oil from native American reservation oil fields. Several US Senators got interested and the largest oil companies told them to look at Koch. The Senators got an FBI agent assigned to investigate and he started observing Koch trucks and gaugers as they pumped oil from the field tanks to their trucks, measuring the amount of oil taken using gauge sticks inserted into the field tanks before and after the pumping. The drivers would record the amount of oil taken and leave a ticket at the site. This ticket determined what Koch owed for the oil taken. When the truck was emptied at its destination an accurate measure of the oil taken could be obtained. The work of the guagers is only approximate and Koch trained the drivers never to be short, i.e. never to have the oil actually delivered be less then the ticket left at the site. To be short meant an immediate termination. The drivers were never instructed to steal oil, they were instructed never to deliver less oil than Koch was obligated to pay for. The obvious and only was to assure that they were not short was to always be long. The Senate passed the investigation to the Justice Department which made Koch hand over its records for three years. In each of these years Koch received an average of 400,000 Barrels of oil per year worth about $10 million that they didn’t pay for. The Justice Dept. didn’t want to charge individual drivers but thought it would be difficult to charge the top executives for the theft. The case did go to trial and was settled for an undisclosed amount. There was bad publicity for Koch but no lasting consequence. This is just another example of Koch pushing beyond the limits of legal and normally understood ethical behavior.

Additional Details on Oil Theft from Christopher Leonard

Two sections of the book deal with Koch treatment of unions, first the union at the Minnesota refinery, and second the Georgia Pacific division unions. The stories are different but similar. Koch refuses to negotiate, changes the work rules, slowly squeezes wages, moves union pensions to 401K s and interferes with health care programs. It is pretty miserable to work a union job at Koch but the alternatives are worse. Charles Koch’s toughness is illustrated by his reaction to a union strike at the Pine Bend refinery in Minnesota, which in 1970 was still a strong union state. Charles Koch hired a Texas oilman whose hero was George Patton to run the refinery. When the workers voted to go on strike, he hired enough non union workers to keep the refinery running and flew them on site by helicopter. The skeletal crew lived on site with their boss. When the teamsters refused to cross the picket line, Koch negotiated a deal whereby Koch drivers would replace the teamsters for the drive through the picket line, load the truck, and return it to the teamster driver. When the strike extended, Koch built a separate road entrance bypassing the picket line and convinced the teamsters to drive their trucks through the new entrance. For specialized maintenance requiring workers from other unions, Koch eventually convinced them to make repairs in spite of the strike. In this way the refinery union was slowly isolated and weakened. They eventually settled on Koch’s original terms, but after losing more than a year of wages.

Georgia Pacific’s plants and warehouses were subjected to modern software systems designed to increase worker productivity. This increased productivity was accompanied by a corresponding increase in injuries, some of them fatal. These injuries would result in OSHA investigations and modest fines, but any government interventions were anathema in Koch’s culture. While trying their best to prevent injuries, the numbers stayed stubbornly high. Stressed employees will make mistakes and the only solution is to decrease the pressure. On the contrary Koch would fire employees that were considered too cautious and careful because that meant they worked slower. Had the OSHA fines been in the millions, I have no doubt Koch would have figured things out to reduce or eliminate injuries.

Koch created a Value Creation Group but this got subdivided and one of the subdivisions was Koch Agriculture. Koch had virtually no experience in agribusiness volatility. In 1997 Koch saw an opportunity to buy century old Purina Mills headquartered in nearby St. Louis. The problem with private equity acquisitions is that is drew Koch into businesses where it had no expertise. They agreed to pay $670 million for a company worth $109 million. Koch borrowed $570 million and put up $100 million of its own money for the purchase. Koch tried to impose the Koch culture on a company with its own very different and well established culture with the result that key employees left the company in droves. Due diligence failed to uncover massive contracts between Purina and hog feedlots which required Purina to produce piglets that the feedlots were under contract to buy and grow using Purina food. When the hog market imploded, the feedlots defaulted on their contracts (that Koch didn’t know existed) and Purina was forced into bankruptcy. Purina and the creditors lawyers believed the Koch corporate veil that was supposed to protect the holding company, was flawed, and Koch was forced to settle by putting up another $60 million in cash to get rid of Purina. Charles Koch fired everyone associated with this disaster and closed the entire acquisitions division.

Koch began a complete reorganization of the business in 1999. Over the years Koch had acquired a wide hodgepodge of unrelated businesses. Koch unloaded many of its pipelines, sold a small chemical company and other odds and ends. At the core of the new structure, Koch Petroleum was rename Flint Hills Resources. Others were simplified and reorganized into Koch Minerals, Koch Supply & Trading, and Koch Chemical Technology Group. New leaders were appointed to run these consolidated businesses. Koch Industries became little more than a holding company protected by a legally impenetrable veil to protect it from problems in its divisions. Charles Koch also finally put to rest the 20 year long legal feud with brother Bill and could totally focus on growing Koch. Koch’s spectacular growth after 2000 was the result of operating one of the largest private equity operations in the country. Private equity finds distressed public companies that can be purchased cheap, converted from publicly traded or coop into privately held companies. Charles Koch from the beginning wanted his company to remain private, to operate in secret, and to forego dividends in favor of reinvesting profits to grow the business. He was proving that he could learn fast from past mistakes, correct them mercilessly and move on. He initiated his “10,000 percent compliance” program discussed earlier at this time to keep the government and regulators off his back. Clinton ushered in the age of financialization in 2000 and George W Bush from Texas and Dick Cheney entered the White House. Koch was set for a decade of spectacular growth.

In 2003, Farmland a depression era coop headquartered in Kansas City wanted to sell a group of liquid nitrogen fertilizer plants all located close to their midwest farm customers. The most expensive component, at 80% in the production of liquid nitrogen is natural gas and domestic natural gas was very expensive. Lower cost imported fertilizer had undermined Farmland’s market. Koch had inside information that fracking was about create a vast increase in the supply of natural gas and prices would plummet. This purchase would mean a significant reentry into agribusiness and the acquisition team didn’t know if Charles Koch was ready to forget the Purina experience but he fully backed acquisition. Natural gas prices plunged and the fertilizer plants became immediately profitable.

Also in 2003 Georgia Pacific approached Koch to see if they were interested in purchasing several struggling pulp mills in Georgia and Washington – Oregon. The mills came with several unionized warehouses for the mill’s products. When the Koch team visited Georgia Pacific’s Atlanta headquarters (51 stories tall) they saw a bloated, hyper luxurious operation. At the same time DuPont came on the market. Overall, Koch was looking at corporate takeovers worth more than $25 billion. Koch acquired both DuPont’s Invista for $4.4 billion and Georgia Pacific for $21 billion. Charles Koch had always disliked borrowing, but borrowing is the foundation of the private equity business. Find an under performing company with lots of cash flow and buy it with borrowed money. Make sure the holding company is protected from the creditors, turn the companies around and use the resulting cash flows to repay the loans. Koch was now willing to borrow seemingly unlimited money to fuel its acquisition appetites. Both DuPont and Georgia Pacific were heavily dependent on the building of new housing which was a hot market right up to the sub prime mortgage crash of 2008. Charles Koch did not panic but scaled back operations at all affected acquisitions and waited to weather the downturn storm.

June 29, 2012 (Reuters) – DuPont Co has settled a $745 million lawsuit brought by Koch Industries Inc’s Invista unit over safety and environmental problems at plants once owned by the large chemical company.

How The Kochs Are Fracking America

The crash of 2008 made fracking economically viable and the supply of natural gas exploded. Then drillers in North Dakota applied fracking to crude oil successfully for the first time. There was an area called the Eagle Ford Shale region near Corpus Christi where Koch’s second light crude refinery was located. Koch’s planners decided on a plan to build pipelines between Eagle Ford and Corpus Christi and to buy and build a ship slip to export any excess crude oil. Charles Koch embraced the plan immediately and only wanted to assure the plans were big enough. Oil from fracking start to flow in 2010 when by the end of the year 139,000 barrels a day were being produced. By 2014 production hit 1.68 million barrels a day roughly 20% of all crude oil produced in the US that year. Because the 1970 Clean Air Act effectively prevented the building of new refineries, Koch’s Corpus Christi refinery enjoyed enormous profits from the newly available light crude.

Koch Brothers War on Renewable Energy

Through this same period the Kochs focused their political attention on fighting renewal energy initiatives at the state level (ALEC), fighting any carbon restrictions at the state and federal level, and rolling back CAFE auto efficiency standards. Charles Koch and his company became much more visible as a result of these massive anti environmental efforts and he started experiencing demonstrations at his gatherings and now requires constant security protection. Gone were the days when Charles could drive his modest old station wagon from the family home to Koch headquarters.