The Failure of Economics

Monday, January 25th, 2010How Markets Fail, John Cassidy, 2009

This book is a devastating indictment of Fed Chairman Alan Greenspan and of economics and economists generally. When academic economics should have been focused on Cassidy’s title question: How do Markets Fail? Instead in a blog entitled “The Unfortunate Uselessness of Most State of the Art Academic Monetary Economics“, Willem Buiter, Professor at prestigious London School of Economics charges:

The typical graduate macroeconomics and monetary economics training received at Anglo-American universities during the past 30 years or so may have set back by decades serious investigations of aggregate economic behavior and economic policy-relevant understanding. It was a privately and publicly waste of time and resources.

Despite this conclusion, Cassidy feels a need to take us through 200 ponderous pages of the history of economic theory. Probably most readers give up far before reaching the heart of the book and the author’s central arguments.

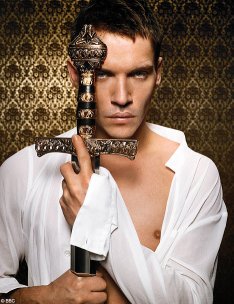

John Von Neumann at Los Alamos

His history starts picking up when, in 1937, polyglot John Von Neumann (computers, Manhattan project, encryption, etc.) decided to write a paper on economics using the new game theory. Von Neumann teased economists of the day that if their articles using mathematics could be thought to have been written in the age of Newton so primitive were their methods. Von Neumann’s article resulted in two changes; better qualified economists left the field to study game theory; and an extensive discussion of the Prisoner’s Dilemma entered economics discussions. Prisoner’s Dilemma asks why multiple independent actors do not cooperate to achieve optimal outcomes. Instead, in study after study, actors assume the worst of others and act accordingly with the result that inferior outcomes result. Classic examples explain why Microsoft’s operating system becomes dominant when Unix and Apple have vastly superior operating systems and why Intel’s microprocessors become dominant when Motorola microprocessors used by Apple and early engineering workstations were clearly superior.

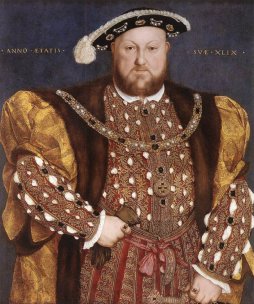

His history is primarily a battle of ideas or ideology between the free marketeers and the Keynesians. The free marketers take control during stable good economic times and go into eclipse during times of economic turmoil lying low and waiting to reemerge when memories of an economic collapse fade. The great depression, its lessons and the dominant period of Keynesian thought held until the 70’s when a combination of high inflation coupled with high unemployment and tagged “stagflation” led to the end of Keynesian dominance and emergence of the Chicago free market school of Hayek and Milton Friedman. The change was complete with the election of Ronald Regan who appointed Alan Greenspan to head the Federal Reserve. Deregulation, started by Carter in Telecommunications and the airlines was extended to banking and finance. The immediate collapse of the savings and loan industry did nothing to slow the resurgence and power of the free marketeers.

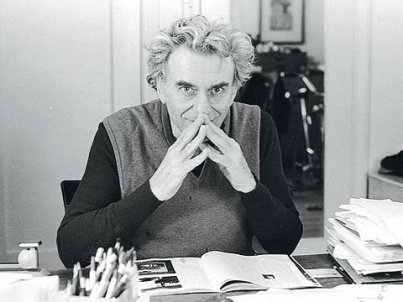

Hyman Minsky

One of the strange things about the history of economics has been the lack of study or interest in banking and the financial economy which is inexplicable given that banks are virtually always at the heart of every economic collapse. Cassidy can find only one economist, Hyman Minsky, working in obscurity at Washington University, who focused on banks and the financial industry and who was an avowed Keynesian who came to the conclusion that the financial market is inherently and violently unstable. Minsky’s books are mostly out of print and Cassidy notes that the recent collapse and freezing of the credit market caused people to bid hundreds of dollars (Cassidy included?) for copies of Minsky’s books on Ebay. The financial market has grown until it now represents a majority of the GDP in the US and if the financial market impact adjusted for inflation is removed from GDP, the US economy has been almost stagnant for the last thirty years. So why did economists not study the key growth portion of the economy? Good question.

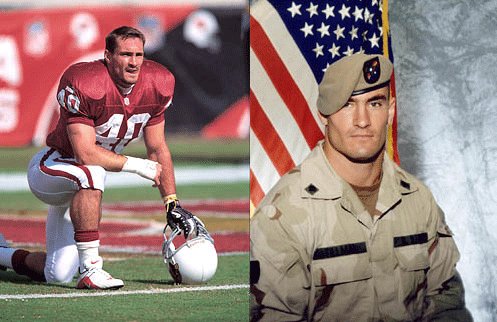

Boston Schemer Charles Ponzi

Minsky’s main insight is that the financial markets most innovative changes are actually Ponzi schemes and he coined the term Ponzi Finance to describe these activities. for Ponzi finance, expected income flows will not cover interest cost, so the firm must borrow more or sell off assets simply to service its debt. The hope is that either the market value of assets or income will rise enough to pay off interest and principal. Hence the need to promote successive asset bubbles to sustain the illusion of profits.

Cassidy turns to the question of why banking and wall street executives continued to put all their resources and investments into the Ponzi finance Sub Prime mortgage market even though many of the executives were shown to be aware that the Sub Prime mortgage market was guaranteed to blow up in their faces and that the housing bubble would burst at some time. He dismisses that short term incentives were at fault since several of the top executives held stock worth more than a billion and the poorest held at least 150 million in stock. So why would these aware and intelligence executives drive their companies off the cliff by continuing to load up on sub prime mortgages? Clearly these executives are unable manage their own behavior and need significant regulatory constraints. Yet Cassidy doubts that regulatory reform is forthcoming.

To illustrate the pressures to support bubbles, Cassidy gives the example of the funds manager who sold his fund’s internet dot com holdings a few months before the bubble burst and was fired while another manager held on to his internet holdings, costing the fund 2.5 billion in losses in the burst but who still managed the same fund five years later. This phenomenon has been labeled rational irrationality. Another way to say investors resemble lemmings.

Almost as an aside, but a subject dear to the heart of Nassim Nicholas Taleb author of The Black Swan; the prdilection of economist to assume that various economic phenomena such as stock prices conform to the Gaussian Bell Curve.

Mandelbrot, creator of chaos theory, took the daily DOW Jones Industrial averages from 1916 to 2003 and calculate the mean and standard deviations. If the data actually fit the Bell Curve, one would expect a daily swing of 7% or more only once every 1,000 years. In fact, such swings occurred 48 times in the period under study. In Taleb’s terms there were a remarkable 48 Black Swans during this period. Yet economists continue to model things like risk in terms of conformity to the Bell Curve. Bell Curves were at the heart of the risk models of LTCM (Long Term Capital Management), the hedge fund that collapsed in 1998 due to the emergence of Black Swans. Similarly, and learning nothing from LTCM, the VAR (Value at Risk) models at the heart of the sub prime mortgage market with its derivatives and insurance and AAA ratings had erroneous Bell Curves at their heart. It was obvious, even to many of the key players, that this market would crash so its hard to call the events of the bubble bursting a Black Swan event.

He finds a choice quote in January 2004 from Alan Greenspan for which Cassidy names the entire period the “Greenspan Bubble Era“;

Recent Regulatory reform coupled with innovative technologies has spawned rapidly growing markets for, among many other products, asset backed securities, collateral loan obligations, and credit default swaps…These increasingly complex financial instruments have contributed, especially over the recent stressful period, to the development of a far more flexible, efficient, and hence resilient financial system than existed just a quarter of a century ago.

Cassidy politely calls Greenspan a Naif.

In spite of his promise to write a book of ideas, Cassidy delves into the actual banking meltdown of 2007 – 2008 in some detail. His purpose is primarily to decry the “moral hazard” of the sequence of events that caused the government to ride to the rescue of irresponsible executives who seem to have learned only that they largely insulated from the repercussions of their risky behavior and who today are engaging in the same risky behavior, this time with Federally borrowed money. Cassidy is pretty depressed that things will never change in this one sided socialism.

This book takes discipline to fight through but there are some rewards.