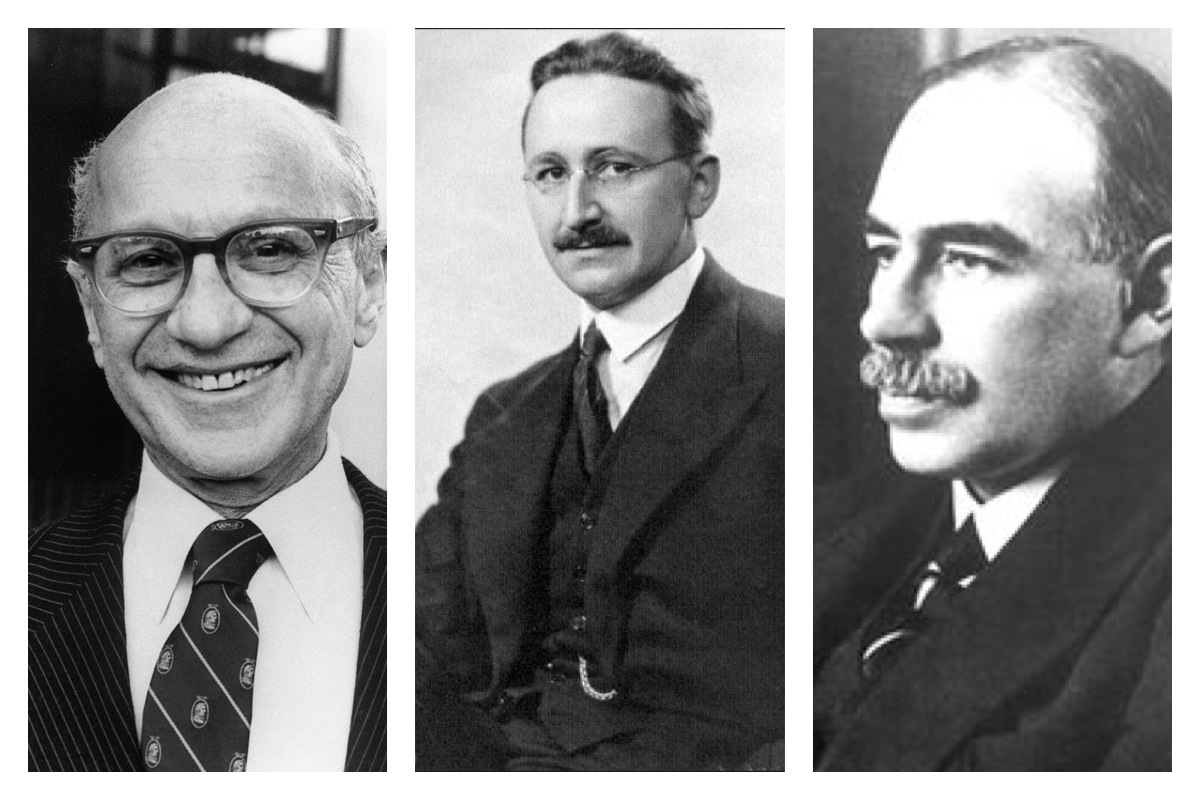

John Maynard Keynes vs laissez-faire: a history

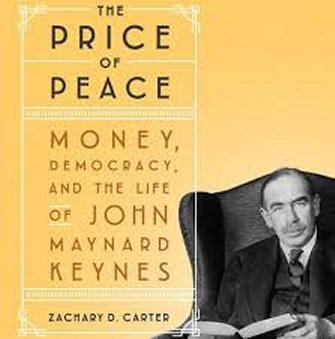

Tuesday, August 11th, 2020The Price of Peace; Money, Democracy, and the Life of John Maynard Keynes, Kachary D. Carter, 2020

Three Conscientious Objectors in 1915 Bertrand Russell, John Maynard Keynes, Lytton Stratchey

As a freshman at Cambridge University, Keynes was invited to join a secretive club, the Apostles, a sort of graduate seminar and dinner party where one member would present a paper. Keynes represented a new generation of Edwardians, leading a sexual revolution with Lytton Strachey, contrasting with the older Victorians like Bertrand Russell. Stratchey wrote of Keynes to Leonard Woolf in 1905, “He analyses with amazing persistence and brilliance. I never met so active a brain (I believe it’s more active than either (G.E.) Moore’s or Russell’s)…he perpetually frightens me.” Bertrand Russell wrote: “Keynes’s intellect was the sharpest and clearest that I have ever known. When I argued with him, I felt that I took my life in my hands, and I seldom emerged without feeling something of a fool.” An artistic grouping, Bloomsbury was born around 1905 at the house where Virginia (Woolf) and her sister Vanessa lived. Apostles Keynes, Leonard Woolf, Lytton Stratchey, E.M. Forster, Clive Bell and others moved to London. In 1906 Keynes took a job at the India Office where he worked on Indian currency and monetary policy.

In 1914, as WWI started, an obscure genius known to some in government from his India Office days, John Maynard Keynes, was summoned to London by Treasury and the Bank of England. Witnessing banker’s pursuit of their own narrow concerns during a bank run crisis, where Bankers focused on their own short-term pecuniary profit, abandoning all thought of “the honour of our old traditions or future good name”, Keynes concluded that political oversight of the bankers was needed. Keynes conceived a solution which Treasury and Parliament blessed that foreign bills could be redeemed for gold but domestic needs including those of the banks would be met with a new alternative paper currency. The plan worked and the run was stopped.

Keynes was invited to Paris for the WWI treaty of peace negotiations. Disturbed by the Allied demand for massive reparations that were unrealistic , Keynes proposed that Germany be allowed to issue bonds guaranteed against default by the Allied governments. Keynes was not privy to the negotiations drawing new borders and breaking up the Ottoman Empire so doesn’t appear aware of the division of oil reserves among the Allies. When Wilson rejected Keynes “Grand Scheme”, Keynes resigned from the peace negotiations and penned maybe his most influential work in 1919, “The Economic Consequences of the Peace” which Carter describes as:

…provincial, shortsighted, vicious, and in many respects deeply unfair polemic. It is also a masterpiece and very likely the most influential work Keynes ever put his name to—a furious tirade against the autocracy, war, and weak politicians. It is at once a howl of rage directed against the most powerful men in the world and an ominous prophecy of the violence that would again sweep the continent in the years to come.

Keynes wrote:

The resulting international system created at Versailles was extremely fragile and would only function if workers believed in it, and workers would not believe in it unless it worked. Break the collective faith in a better tomorrow, and workers will walk off the job, riot in protest, or worse.

The principle of accumulation based on inequality was a vital part of the pre-war order of Society and of progress as we then understood it. This principle depended on unstable psychological conditions, which it may be impossible to recreate. It was not natural for a population, of whom so few enjoyed the comforts of life, to accumulate so hugely. The war has disclosed the possibility of consumption to all and the vanity of abstinence to many.

Bolshevism in Russia was already known to all as an alternative to La Belle Epoque. All over Europe, but particularly in Germany conditions were ripe for the rise of a strongman. Without jobs, food, a sense of purpose, and confidence in a better tomorrow, Europe was already on the path to another war.

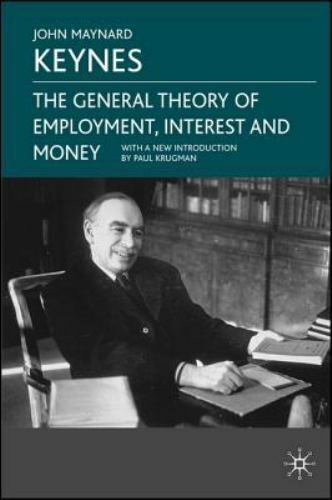

Keynes formalized his political theory of economics with three lectures in 1926 “The General Theory of Employment, Interest and Money“,”The End of Laissez-Faire“, and “A Short View of Russia“. Overlooked in Britain even though Bloomsbury loved them, they formed the core of a unique, practical political theory that the United States would apply on a vast scale during the great depression and WWII.

In 1930, Keynes published “A Treatise on Money” an assault on the ability of central bank interest rates to affect investment. Keynes suggested that the state spend money on public works since domestic investment was the problem. This direct assault on laissez-faire caused Austrian Friedrich von Hayek to pen two part indictment of the book. Milton Friedman later claimed von Hayek encourage a do nothing policy that did harm by recommending that “you just have to let the bottom drop out of the world.” Keynes himself responded to von Hayek; “one of the most frightful muddles I have ever read.”

<> <> <>

Franklin D. Roosevelt in his inaugural address in 1933 said

Primarily this is because the rulers of the exchange of mankind’s goods have failed, through their own stubbornness and their own incompetence, have admitted their failure, and abdicated. Practices of the unscrupulous money changers stand indicted in the court of public opinion, rejected by the hearts and minds of men…They know only the rules of a generation of self-seekers. They have no vision, and when there is no vision the people perish…The money changers have fled from their high seats in the temple of our civilization. We may now restore the temple to the ancient truths. The measure of the restoration lies in the extent to which we apply social values more noble than mere monetary profit.

In his first 100 days FDR created the FDIC, the SEC, the TVA, and the Agricultural Adjustment Administration.

Felix Frankfurter, a friend of Keynes and appointee to the US Supreme Court in 1939, delivered a letter from Keynes to FDR and arranged meetings for Keynes in 1934 with key administration players not totally on board with Keynesian ideas. One player Keynes met was John Kenneth Galbraith who was running the office of price administration. Galbraith described the meeting as the Pope visiting the lowly village priest. Keynes largely found himself preaching to the choir.

FDR met Keynes and thought him politically naive about the President’s relationship with Wall Street. FDR believed a banking industry hostile to his reforms was driving up interest rates on government debt by sitting out Treasury bill auctions. “There is a practical limit to what the Government can borrow– especially because the banks are offering passive resistance in most of the large centers,” Keynes did make progress with Fed Chairman Eccles who understood the need to keep interest rates low to help the government spend its way out of the Depression.

In 1936 Keynes published his most important work “The General Theory of Employment, Interest and Money“, a work that Carter calls the most important work in economics in 160 years, to be compared with the monuments of Aristotle, Thomas Hobbes, Edmund Burke, and Karl Marx.

It is a theory of democracy and power, of psychology and historical change, a love letter to the power of ideas. The book is dangerous because it demonstrates the necessity of power. It is a liberation book because it re-framed the central problem at the heart of modern economics as the alleviation of inequality, pivoting away from the demands of production and the incentives facing the rich and powerful that had occupied economists for centuries. It is a frustrating book because it is written in novel abstractions, argued in convoluted sentences and dense equations. And it it a work of genius because it proves a simple truth that, once offered, seems obvious: Prosperity is not hard-wired into human beings; it must be orchestrated and sustained by political leadership.

Keynes said of the genius of Sir Issac Newton:

Newton could hold a problem in his mind for hours and days and weeks until it surrendered to him its secret. Then being a supreme mathematical technician he could dress it up, how you will, for purposes of exposition, but it was his intuition which was preeminently extraordinary…The proofs, for what they are worth, were, as I have said, dressed up afterwards–they were not the instrument of discovery.

Explaining his own method in The General Theory Keynes says:

The object of our analysis is, not to provide a machine, or method of blind manipulation, which will furnish an infallible answer, but to provide ourselves with an organized and orderly way of thinking out particular problems…Too large a proportion of recent “mathematical” economics are mere concoctions, as imprecise as the initial assumptions they rest on, which allow the author to lose sight of the complexities and inter-dependencies of the real world in a maze of pretensions and unhelpful symbols.

The term macroeconomics hadn’t even been coined. Keynes not only invented modern economics, he invented the modern economist and placed him at the top of the new intellectual power structure. The book is a collaborative work done by the Cambridge “Circus” an almost cult like group with its own private language. The two most important contributors beyond Keynes were Joan Robinson and Richard Kahn. Carter says Robinson is the most important economist never to have won a Nobel prize in economics. Two of her students Amartya Sen and Joseph Stiglitz were honored with the Nobel prize. In fact she was only named full professor at Cambridge in 1965, thirty years after publication of her most significant work for which she is not credited. Carter likens Joan Robinson to Rosalind Franklin who discovered the double helix of DNA and was never recognized. Joan Robinson’s published contributions to economics continued until her death in 1983. Much of the The General Theory is incomprehensible. The book is difficult and obscure because Keynes wanted it to be. Its sheer ugliness created a small industry of interpreters. Two economists won Nobel prizes for interpreting the work.

<> <> Joan Robinson and Richard F Kahn

Keyesian economics found its first real world application during the FDR years. For Joan Robinson “The economic theory which was developed in America was a return to pre-Keynesian doctrines that smothered everything important in Keynes.” For Richard Kahn, the re-engineering of The General Theory into mathematics was a Faustian bargain–a fatal turn that would ultimately lead to Keynes being discredited.

In June 1942, Keynes was rewarded for his service with a hereditary peerage. On 7 July his title was gazetted as Baron Keynes, of Tilton, in the County of Sussex.

Maynard’s wife Lydia was a principal ballet dancer with Ballets Russes under Diaghilev and partnered with Nijinsky

Lydia partnered by Vaslav Nijinsky

Lydia partnered by Vaslav Nijinsky

There is a youtube video of Lydia dancing with George Balanchine in 1929.

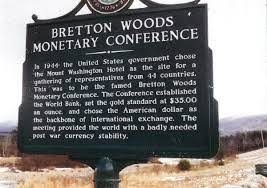

Bretton Woods agreement 1944-1972

Lydia was 5’0″ Maynard was 6’7″

Lydia was 5’0″ Maynard was 6’7″

In 1944 Keynes attended the Bretton Woods conference in New Hampshire to hammer out a new international economic system. The Mount Washington Hotel overlooked the Ammonoosuc River where Keynes’s wife Lydia bathed nude each morning.

Keynes called for a new Supernational Bank to regulate the global money supply, currency, and trade flows. This international central bank would issue “Supernational Bank money (SBM) to national central banks like the Federal Reserve, the Bank of England, and their other counterparts throughout the world. These national central banks would borrow SBM from the Supernational Bank as a matter of course as they conducted their ordinary monetary policy operations.

The Supernational Bank would allow nations to grapple with domestic problems without resorting to deflation. Nations would never have to worry about running out of money in an emergency, because the Supernational Bank would always be there to provide money on reasonable terms. No government would have to intentionally create unemployment to resolve a currency or trade problem. Under the old system, when loans became unavailable for any reason–war, banking instability, bad monetary policy, a stock market bubble, or a simple disinterest in foreign lending–the only way a country running a trade deficit to fix its situation would be to force down the price of its goods in foreign markets. Ultimately it would resort to deflation and mass unemployment to do so. Keynes argued the surplus nations were not injured by countries that ran deficits. While the deficit country ran up large financial debts, the surplus country enjoyed fat export trade that employed its workers and raised the standard of living.

What the world also needed was an international authority that could punish countries for running a persistent trade deficit or a persistent trade surplus. Keynes proposed an International Clearing Union (ICU). Each participating central bank would open an account with the ICU. International trade payments would be made through those accounts, using a new international currency called Bancor that the ICU would create at will. When a country ran a persistent deficit or a persistent surplus, the ICU would require it to revalue its currency to bring the system back toward balance. The revaluations would be up or down to a limit of 5%.

Unfortunately for Keynes’s vision, Harry Dexter White, the US representative of the FDR administration arrived at Bretton Woods with a plan already formulated and the US had the clout to get its way. Keynes’s plan had been rejected before the conference even began. Instead all nations that joined the Bretton Woods project would agree to make their currencies convertible into dollars at a fixed exchange rate. The dollar only would be convertible into gold at a price later fixed at $35 per ounce. An International Monetary Fund (IMF) would be established to provide emergency loans in a crisis. A World Bank would be created to assist with post war reconstruction.

Instead of an international regulatory apparatus, Keynes got a gold standard with a bailout fund. White spend much of his time at the conference trying to secure USSR participation. He failed and the USSR never ratified the Bretton Woods agreement. Britain was broke and Keynes could do nothing about the outcome of the conference. Keynes died on Easter Sunday 1946.

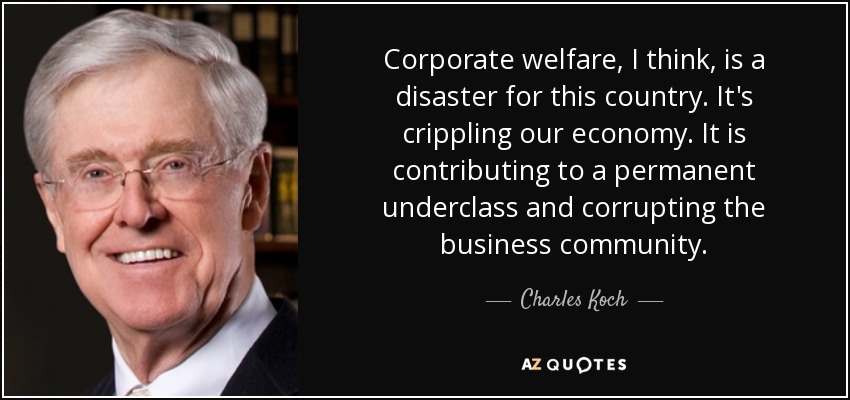

The backlash against FDR’s New Deal and War powers was led by the bankers, wall street, and the corporate American elite. Undermining Keynesian economics combined the McCarthy era Communist scare accusations, the rise of the Ayn Rand inspired libertarian movement emphasizing unfettered individual freedom (freedom from government interference), and the resurgence of laissez-faire (market fundamentalism) economics centered at the Chicago School with von Mises and von Hayek and the London School of Economics.

Chicago School graduate Paul Samuelson wrote the textbook Economics: An Introductory Analysis, first published in 1948 that became the principal introduction to economics for generations of American students including this reader. While incorporating some Keynesian ideas, Samuelson was careful to couch these ideas in the long tradition of market fundamental economics. Some labeled Samuelson a neo-Keynesian .

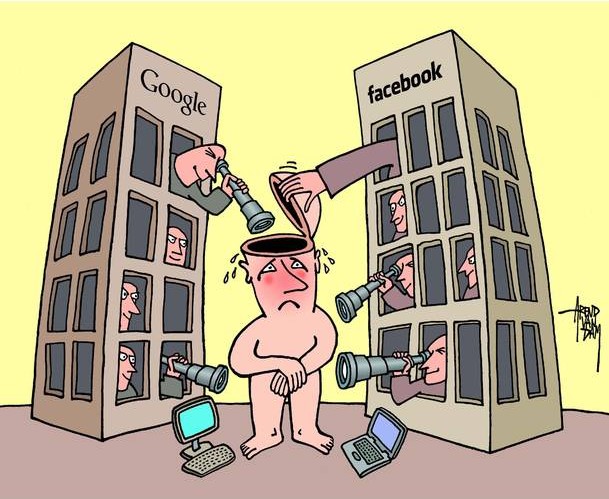

In 1958 Galbraith published his sensational The Affluent Society where the economics of scarcity had been replaced by an economy of abundance able to meet the needs of everyone with advertising used to encourage further consumption. Galbraith noted that great inequality still existed in America. The book had an immediate and wide spread impact on economic discussion which Carter calls similar to the impact of Thomas Piketty’s Capital in the Twenty-First Century, a history of inequality of income and wealth in France, Britain, and America. Galbraith was perhaps the best known member of the JFK brain trust. Expecting a cabinet appointment, Galbraith was instead named ambassador to India, then under Nehru and the Congress party. Galbraith was a vocal opponent of US involvement in Vietnam so likely JFK wanted to isolate him to quiet his opposition.

In 1972, Nixon shocked the world announcing the end of the post war Bretton Wood system. The gold standard was abandoned and massive monetary and fiscal stimulus programs were launched with low interest rates and business tax cuts. A 10% import tariff would be imposed and price controls put into place. Carter doesn’t discuss it but the US had moved from a trade creditor nation to a trade deficit nation by the late 1960’s. Strongest of the Creditors were Germany and Japan. Sometime about 1971, a young London School of Economics educated Paul Volcker penned a three page secret memo to his boss Henry Kissinger suggesting that foreign nations should be encouraged to have the United States recycle their surpluses through Wall Street. Yanis Varoufakis claims to have seen this secret memo, but the reality is that approximately 70% of all foreign trade surpluses, including China, are now recycled by the United States. Thus a new industry, financialization, which today dominates the US economy was created.

Volcker was named Fed Chairman by Jimmy Carter in 1979. He promptly raised interest rates to an unprecedented peak of 20%. Volcker had turned the Federal Reserve into the primary instrument of US economic policy to fight inflation. Further creative uses of the Fed would be used in the 2008 banking crisis.

The final nails in the coffin of New Deal economic mechanisms occurred under Bill Clinton taking the advise of Bob Rubin and Larry Summers. The Glass-Steagall act was repealed allowed the merger of banks with wall street to create too big to manage financial monsters. Then Clinton declared that there was no need to regulate Wall Street created derivatives that were at the heart of the 20008 sub prime mortgage crisis. Carter points out that the credit default swap (CDS) was the most explosive of these new derivatives. The CDS was a form of insurance whereby a default of an insured derivative would pay the holder. There was no requirement that the entity taking out the insurance actually owned the derivative insured.

The Obama administration was economically scammed by Tim Geithner and Larry Summers. The big banks were bailed out, Glass-Steagall was not reinstated, no banker was prosecuted for their illegal activities. And, according to Carter, 9.3 million lost their homes with government doing virtually nothing to preserve home ownership. A $75 billion plan designed to save 4 million homes never happened. The money was allocated but never spent. The family loss of homes contributed greatly to the increase in unemployment during this time.

Democratic Representative Dennis Cardoza of California in 2011 exclaimed:

For the life of me, I can’t figure out why a community organizer who says he cares about families, who says he cares about communities, has turned his back on one of the biggest problems in America.

Keynes believed that an enlightened management of the economy to produce widespread prosperity and job security would alleviate the problems of unrest that lead to revolutions either communist or fascist. Today the world has the highest level of inequality ever measured.

In 2008, Joseph Stiglitz calculated that if the $48 trillion global economy were simply divided among every one of its inhabitants, a family of four world receive $28,000, high enough to end poverty in every country. Carter calculated that the 2018 economy of $85.8 trillion economy and 7.5 billion people would yield an income of $45,000 for each family of four. “The economic problem of humanity is no longer a problem of production but of distribution–inequality.

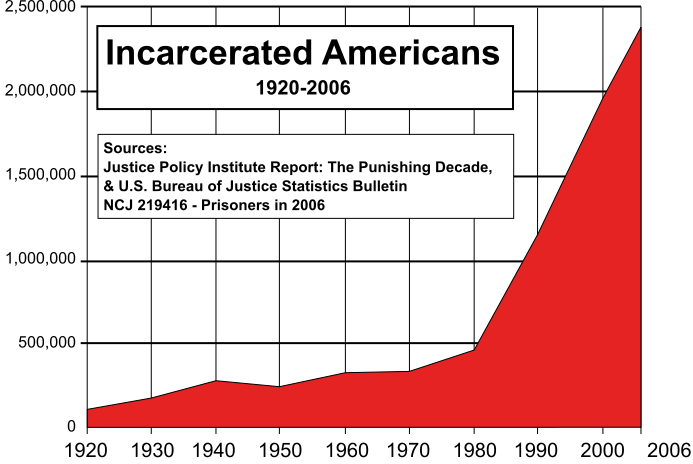

Keynes was a conscientious objector dedicated to the elimination of the causes of war. Yet the history of the US after WWII was one of almost continuous real armed conflict and a continuous succession of virtual wars: the cold war til 1992, the war on drugs, and the war on terror after 9/11, The later two were not wars against state actors but against amorphous largely hidden force scattered globally. State actors found themselves invariably drawn into all these virtual wars often with terrible consequences. In real shooting wars with armies, Korea was fought to a draw; Vietnam was lost at a cost of more than 1 million lives; Afghanistan and Iraq never end; Syria and Libya appear to be without resolution. In foreign policy, the US, starting in 1953 and continuing to this day, assist in the overthrow of governments in country after country. The US today is the world’s greatest threat to stability and peace.

As Piketty documents, we are living in a period of unprecedented inequality of income and wealth. Carter concludes, the US government has remained, with the exception of Bill Clinton, stubbornly Keynesian but Keynesian principals are applied only during ever escalating economic crises. Applying Keynesian solutions in government policy sporadically and blind to people’s suffering serves only to rescue the oligarchs from their own incompetence and crimes. This malignant phenomenon has been named “Corporate Socialism“. The failures of the 2008 banking crisis highlighted the bankruptcy of Market Fundamentalist views of the world. Without extensive, enlightened, humane state management, unfettered capitalism is capable of generating enormous instability and suffering that only the state can correct. As an optimist foresees, the global economy, properly managed by the state, is capable of reducing income and wealth inequality and improve the lives and quality of life of everyone on earth, and eliminate war.

A bit of trivia; Keynes was 6’7″, Galbraith was 6’9″ and Volcker was 6’7″.

John Maynard Keynes and Harry Dexter White at Bretton Woods

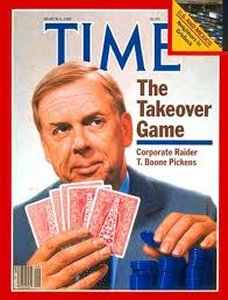

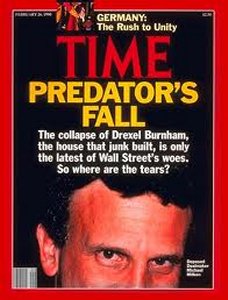

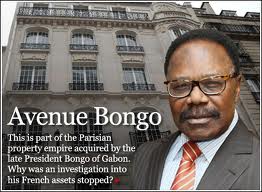

John Maynard Keynes and Harry Dexter White at Bretton Woods Omar Bongo’s Paris

Omar Bongo’s Paris Caymans

Caymans  Hong Kong

Hong Kong Carl Levin

Carl Levin  Graham at UBS

Graham at UBS